Question: You just started a summer internship with the successful management consulting firm of Brooks & Angelou, which specializes in social and environmental issues. Your first

You just started a summer internship with the successful management consulting firm of Brooks & Angelou, which specializes in social and environmental issues. Your first day on the job was a busy one, as the following problems were presented to you.

Required:

Supply the requested comments in each of the following independent situations.

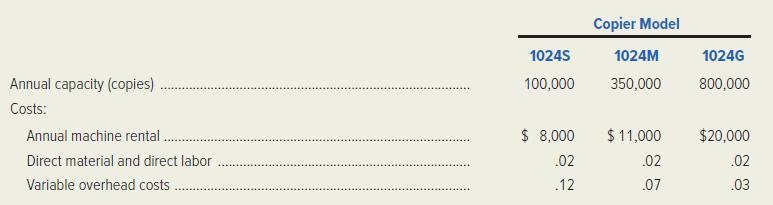

1. Front Yard Printing, has established 500 convenience copying centers in underserved neighborhoods throughout the southeast. In order to increase its impact, the company is considering three new models of laser copiers for use in producing high-volume, high-resolution copies. These high-resolution copies would be added to the growing list of products offered in Front Yard’s copy shops. The selling price to the customer for each high-resolution copy would be the same, no matter which machine is installed in the shop. The three models of laser copiers under consideration are 1024S, a small volume model; 1024M, a medium-volume model; and 1024G, a large-volume model. The annual rental costs and the operating costs vary with the size of each machine. The machine capacities and costs are as follows:

a. Calculate the volume level (number of copies) at which Front Yard Printing would be indifferent to acquiring either the small-volume model laser copier, 1024S, or the medium-volume model laser copier, 1024M.

b. The management of Front Yard Printing is able to estimate the number of copies to be sold at each copy center. Present a decision rule that would enable the organization to select the most profitable copier without having to make a separate cost calculation for each establishment.

2. C. Bird Enterprises (CBE) is evaluating a special order it has received for a silicon-based component to be used in low-cost solar panels. CBE would like to support this initiative to increase adoption of solar power. Moreover, the company has recently been operating at less than full capacity, so the firm’s management will accept the order as long as the price offered exceeds the costs that will be incurred in producing the panels. Brooks & Angelou has been asked for advice on how to determine the cost of two raw materials that would be required to produce the order.

a. The special order will require 800 gallons of zante, a highly perishable material that is purchased as needed. CBE currently has 1,200 gallons of zante on hand, because the material is used in virtually all of the company’s products. The last time zante was purchased, CBE paid $5.00 per gallon. However, the average price paid for the zante in stock was only $4.75. The market price for zante is quite volatile, with the current price at $5.50. If the special order is accepted, CBE will have to place a new order next week to replace the 800 gallons of zante used. By then the price is expected to reach $5.75 per gallon.

Using the cost terminology introduced in this chapter, comment on each of the cost figures mentioned in the preceding discussion. What is the real cost of zante if the special order is produced?

b. The special order also would require 1,500 kilograms of vitis, a material not normally required in any of CBE’s regular products. The company does happen to have 2,000 kilograms of vitis on hand because it formerly manufactured a silicon-based product that used the material.

CBE recently received an offer of $14,000 from Solo Industries for its entire supply of vitis. However, Solo Industries is not interested in buying any quantity less than CBE’s entire 2,000-kilogram stock. CBE’s management is unenthusiastic about Solo’s offer because CBE paid $20,000 for the vitis. Moreover, if the vitis were purchased at today’s market price, it would cost $11.00 per kilogram. Due to the volatility of the vitis, CBE will need to get rid of its entire supply one way or another. If the material is not used in production or sold, CBE will have to pay $1,000 for each 500 kilograms that is transported away and disposed of in a hazardous waste disposal site. Using the cost terminology introduced in this chapter, comment on each of the cost figures mentioned in the preceding discussion. What is the real cost of vitis to be used in the special order?

3. A local PBS station has decided to produce a TV series on animal welfare. The producer of the TV series, Lakeisha Willis, is currently attempting to analyze the feasibility of the projected costs for the series. Willis intends to send a TV production crew on location to shoot various agricultural and food processing scenes as they occur. If the four-week series is shown in the 8:00–9:00 p.m. prime-time slot, the station will have to cancel a wildlife show that is currently scheduled. Management projects a 10 percent viewing audience for the wildlife show, and each 1 percent is expected to bring in donations of $10,000. In contrast, the animal welfare show is expected to be watched by 15 percent of the viewing audience. However, each 1 percent of the viewership will likely generate only $5,000 in donations. If the wildlife show is canceled, it can be sold to network television for $25,000. Using the cost terminology introduced in this chapter, comment on each of the financial amounts mentioned in the scenario above. What are the relative merits of the two shows regarding the projected revenue to the station?

Annual capacity (copies) Costs: Annual machine rental. Direct material and direct labor Variable overhead costs 1024S 100,000 $ 8,000 .02 .12 Copier Model 1024M 350,000 $ 11,000 .02 .07 1024G 800,000 $20,000 .02 .03

Step by Step Solution

3.40 Rating (169 Votes )

There are 3 Steps involved in it

1 a Front Yard Printing would be indifferent to acquiring either the smallvolume copier 1024S or the mediumvolume copier 1024M at the point where the costs for 1024S and 1024M are equal This point may ... View full answer

Get step-by-step solutions from verified subject matter experts