Assume deterministic interest rates. Following our discussion in Section 12.1.4, derive the quanto effect of having a

Question:

Assume deterministic interest rates. Following our discussion in Section 12.1.4, derive the quanto effect of having a stochastic funding spread assuming that the asset follows a standard lognormal process ![]() and the funding spread follows a Hull-White process with constant parameters (except for time-dependent drift),

and the funding spread follows a Hull-White process with constant parameters (except for time-dependent drift), ![]() Hence, see that if the correlation between the asset and the funding spread is zero, there is no quanto adjustment.

Hence, see that if the correlation between the asset and the funding spread is zero, there is no quanto adjustment.

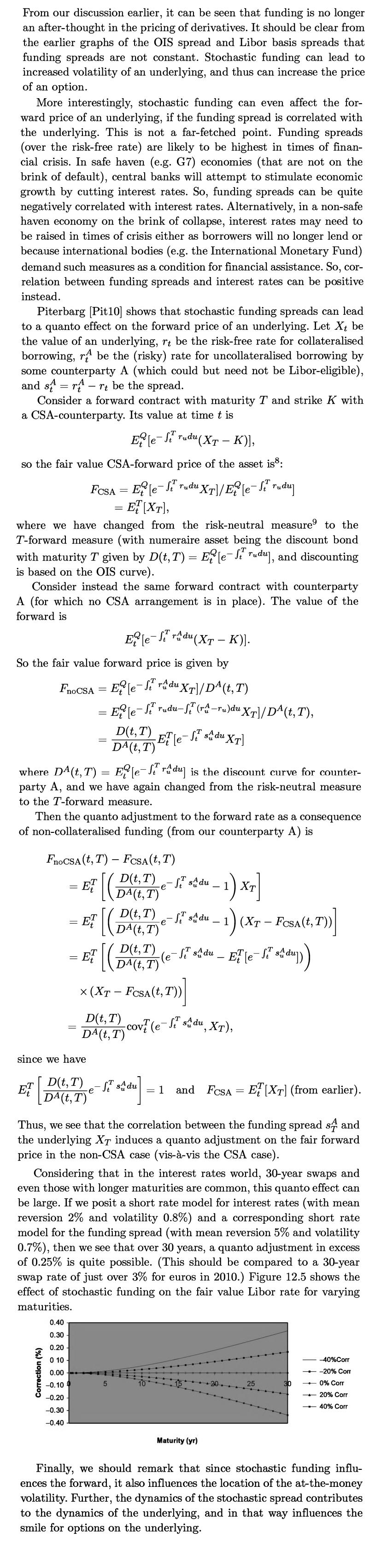

Section 12.1.4,

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: