Notwithstanding the discussion in Section 12.1.4, since we forecast based on Libor, the martingale equation only holds

Question:

Notwithstanding the discussion in Section 12.1.4, since we forecast based on Libor, the martingale equation only holds for risky discounting at the credit-worthiness of Libor counterparts. As such, OIS discounting induces a quanto correction. In the developed world, it is common for interest rates to be lowered in times of crisis to simulate growth. As such, what should the direction of the quanto correction be? (Note that this is really just a theoretical discussion, since such a quanto correction is accounted for by market quotes which are based on Libor forecasting and OIS discounting.)

Section 12.1.4,

Transcribed Image Text:

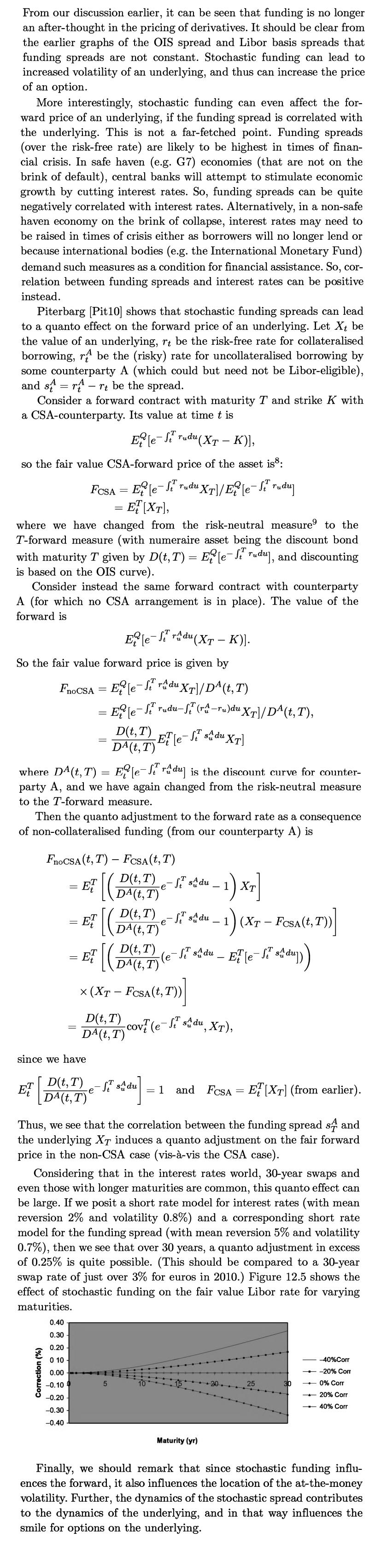

From our discussion earlier, it can be seen that funding is no longer an after-thought in the pricing of derivatives. It should be clear from the earlier graphs of the OIS spread and Libor basis spreads that funding spreads are not constant. Stochastic funding can lead to increased volatility of an underlying, and thus can increase the price of an option. More interestingly, stochastic funding can even affect the for- ward price of an underlying, if the funding spread is correlated with the underlying. This is not a far-fetched point. Funding spreads (over the risk-free rate) are likely to be highest in times of finan- cial crisis. In safe haven (e.g. G7) economies (that are not on the brink of default), central banks will attempt to stimulate economic growth by cutting interest rates. So, funding spreads can be quite negatively correlated with interest rates. Alternatively, in a non-safe haven economy on the brink of collapse, interest rates may need to be raised in times of crisis either as borrowers will no longer lend or because international bodies (e.g. the International Monetary Fund) demand such measures as a condition for financial assistance. So, cor- relation between funding spreads and interest rates can be positive instead. Piterbarg [Pit10] shows that stochastic funding spreads can lead to a quanto effect on the forward price of an underlying. Let Xt be the value of an underlying, rt be the risk-free rate for collateralised borrowing, r be the (risky) rate for uncollateralised borrowing by some counterparty A (which could but need not be Libor-eligible), and sr rt be the spread. Consider a forward contract with maturity T and strike K with a CSA-counterparty. Its value at time t is Ele-Strudu ¹u (XT - K)], so the fair value CSA-forward price of the asset is: FCSA = ELerudu XT]/EX[e-² rudu] ET [XT], where we have changed from the risk-neutral measure to the T-forward measure (with numeraire asset being the discount bond with maturity T given by D(t, T) = E?[e-Serudu], and discounting is based on the OIS curve). Consider instead the same forward contract with counterparty A (for which no CSA arrangement is in place). The value of the forward is Ele-Srdu (XT - K)]. So the fair value forward price is given by FnoCSA = Eedu XT]/D¹(t, T) = where DA (t, T) E[e-du] is the discount curve for counter- party A, and we have again changed from the risk-neutral measure to the T-forward measure. ET Then the quanto adjustment to the forward rate as a consequence of non-collateralised funding (from our counterparty A) is Ele-Si rudu-ſi (r^-ru)du XT]/Dª(t,T), D(t, T) DA(t, T) FnoCSA (t,T) - FCSA(t, T) = Correction (%) D(t, T) - B² [(D4-1²-1) X7] = e x XT DA(t, T) since we have -Elle- ET (D(t, T) 0.40 0.30 0.20 0 10 0.00 -0.100 -0.20 -0.30 -0.40 D(t, T) - sdu DA(t, T) e - ST s du XT] Et B² [( DA(1t, T) 5(e-li sidu - El (e-f² sâ du))) t, T))] X (XT FCSA (t, T)) - D(t, T) cov (e-fsdu, XT), DA(t, T) - S² s^ du] = 5 e-² at du _ 1) (XT - FOSA(t, T))] - 10 du 1 Thus, we see that the correlation between the funding spread s and the underlying XT induces a quanto adjustment on the fair forward price in the non-CSA case (vis-à-vis the CSA case). Considering that in the interest rates world, 30-year swaps and even those with longer maturities are common, this quanto effect can be large. If we posit a short rate model for interest rates (with mean reversion 2% and volatility 0.8%) and a corresponding short rate model for the funding spread (with mean reversion 5% and volatility 0.7%), then we see that over 30 years, a quanto adjustment in excess of 0.25% is quite possible. (This should be compared to a 30-year swap rate of just over 3% for euros in 2010.) Figure 12.5 shows the effect of stochastic funding on the fair value Libor rate for varying maturities. and FCSA ETXT] (from earlier). Maturity (yr) - 20. 25 -40%Corr -20% Corr 0% Corr 20% Corr -40% Corr Finally, we should remark that since stochastic funding influ- ences the forward, it also influences the location of the at-the-money volatility. Further, the dynamics of the stochastic spread contributes to the dynamics of the underlying, and in that way influences the smile for options on the underlying.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

In this discussion we are considering the impact of stochastic funding spreads on the fair pricing o...View the full answer

Answered By

Vijesh J

My passion to become a tutor is a lifetime milestone. Being a finance and marketing professional with hands-on experience in wealth management, portfolio management, team handling and actively contributing in promoting the company. Highly talented in managing and educating students in most attractive ways were students get involved. I will always give perfection to my works. Time is the most important for the works and I provide every answer on time without a delay. I will proofread each and every work and will deliver a with more perfection.

4.70+

5+ Reviews

15+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Foremost Corporation incurred the following costs: Beginning direct materials inventory Beginning work-in-process inventory Beginning finished goods inventory Ending direct materials inventory Ending...

-

Planning is one of the most important management functions in any business. A front office managers first step in planning should involve determine the departments goals. Planning also includes...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

Under what circumstances should derived associations be used?

-

Hawi Inc. has net income of $200,000, average shares of common stock outstanding of 40,000, and preferred dividends for the period of $20,000. What is Hawis earnings per share of common stock ? Sid...

-

Explain the two approaches to matching goals to facts in a database.

-

Standard cost is a (a) Predetermined cost (b) Variable cost (c) Fixed cost (d) Profit

-

Neighborhood Supermarkets is preparing to go public, and you are asked to assist the firm by preparing its statement of cash flows for 2014. Neighborhood's balance sheets at December 31, 2013 and...

-

True or false: Dividend is considered active income.

-

The Ho-Lee model assumes that the short rate has stochastic differential equation dr t = (t)dt + crdW t . Note that the money market account is defined via B T = e 0 T rudu and the discount bond is...

-

Consider a flat Libor discount curve given by D(0, T) =e 0.03T . Suppose that the OIS discount curve is D (0,T) = e 0.028T . Compute the swap rate (annual fixed coupons, semi-annual floating coupons)...

-

In The design of a rapid transit system, it is necessary to balance the average speed of a train against the distance between stops. The more stops there are, the slower the trains average speed. To...

-

(a)The local police station found that the speed of vehicles travelling around the suburb in the 60 km/hour zone varies uniformly between 55 km/hour and 62 km/hour. What is the probability that the...

-

Consider the following fixed-point iteration: xn+1 = g(xn), where [f(x)] 2 g(x) = x (x + f(x)) f(x)* (a) What is the order of convergence for the method? (e.g. what is p?). Hint: Show that the method...

-

Problem 1. In a study of infant birth weight and maternal factors, the newborn babies were categorized as being either small size for gestational age (N=201) or normal size (N=2089). The following...

-

Max 1 page allowed] Consider a DRAM chip of capacity 256 KB and each memory location contains 8 bits. The memory chip is organized in matrix form with equal number of rows and column for each memory...

-

find the dimensions of a notman window of perimeter 3 9 ft that will admit the greatest possible amount of light. Round answer to two decimal places

-

Create a spreadsheet that duplicates Table 4-1. Make it flexible enough that you can investigate the impact of different interest rates and principal loan amounts without changing the structure of...

-

Cassandra Casey operates the Futuristic Antique Store. She maintains subsidiary ledgers for accounts payable and accounts receivable. She presents you with the following information for October 2019:...

-

Predict the products that are expected when each of the following alkenes is treated with ozone followed by DMS: a. b. c. d. e. f.

-

Draw the products obtained when 3,3,6-trimethylcyclohexene is treated with NBS and irradiated with UV light.

-

Draw all possible stereo-isomers for each of the following compounds. Each possible Stereo-isomer should be drawn only once: a. b. c. d. e.

-

You buy a stock for $35 per share. One year later you receive a dividend of $3.50 per share and sell the stock for $30 per share. What is your total rate of return on this investment? What is your...

-

Filippucci Company used a budgeted indirect-cost rate for its manufacturing operations, the amount allocated ($200,000) is different from the actual amount incurred ($225,000). Ending balances in the...

-

Yard Professionals Incorporated experienced the following events in Year 1, its first year of operation: Performed services for $31,000 cash. Purchased $7,800 of supplies on account. A physical count...

Study smarter with the SolutionInn App