Over the past several years, pharmaceutical companies have begun leveraging customer loyalty and engagement research to strengthen

Question:

Over the past several years, pharmaceutical companies have begun leveraging customer loyalty and engagement research to strengthen competitive positionings, improve customer experiences, and deliver more engaging marketing. For pharmaceutical companies, winning the loyalty game means achieving a greater share of physicians who will give their company and product the benefit of the doubt; while creating fewer disloyal physicians—those who will avoid their product whenever possible.

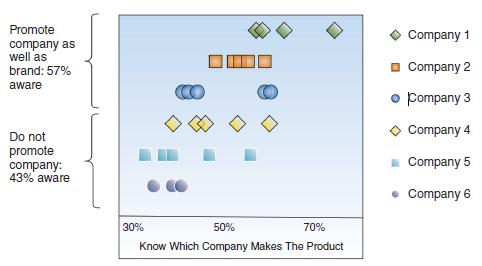

As Figure 1 shows, there is a wide range of manufacture recognition. (Each row represents the products made by one company.) The firms at the top have successfully promoted their overall brands and most physicians know which companies make their products. The bottom row shows, however, that there are still medications whose manufacturers are known by fewer physicians.

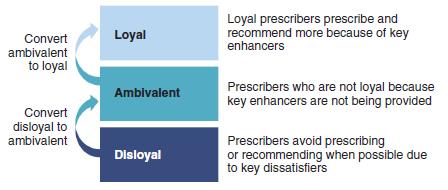

As Figure 2 shows, building deeper relationships with physicians requires a two-pronged effort: converting ambivalent physicians to loyal ones and fixing the problems that are making some physicians disloyal. Further analysis of other data reveals an important discovery: The two lists of priorities are not the same. The implication is that different strategies are required to build loyalty and to eliminate disloyalty.

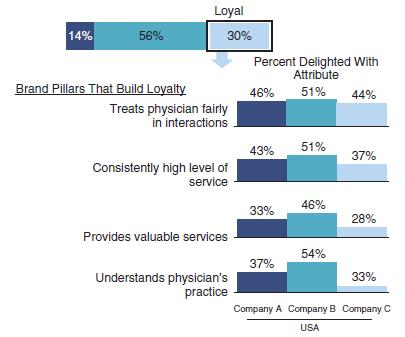

Figure 3 shows the strongest four attributes in terms of their impact on loyalty—with typical results from this kind of analysis. We learn that physicians are more likely to be loyal if they believe that the company:

(1) Treats physicians fairly in their interaction;

(2) Provides a consistently high level of service;

(3) Delivers valuable services; and

(4) Understands the physician’s practice.

Figure 1

Figure 2

Figure 3

Questions

1. You are the marketing manager for a big pharma company. What are four key take always from this research?

2. For every figure, explain what types of scales could have been used to derive the data.

3. The loyalty index and satisfaction score proved to be better indicators of revenue per physician than the net promoter scale. What implications, if any, does this have for NPS?

4. Now many prescription drugs are promoted directly to the final consumer. Should this have been considered in the research? If so, how might this be measured?

Step by Step Answer: