Howard Corporation conducts a manufacturing business and has a compelling need to accumulate earnings. Its January 1,

Question:

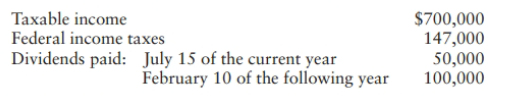

Howard Corporation conducts a manufacturing business and has a compelling need to accumulate earnings. Its January 1, E&P balance is $600,000. It reports the following operating results for the current year:

Other information relating to Howard's current year operations is as follows:

NOL carryover from last year deducted in the current year . . . . . . . . . . $100,000

Net capital gain . . . . . . . . . . . . . . . . .. .. . . . . . . . . . . .. . . . . . . . . .. . . . . . . 100,000

Dividends received from 10%-owned domestic corporation . . . . . . . . . 75,000

Current year E&P before dividend payments is $400,000. Howard can justify the retention of $120,000 of current E&P to meet the reasonable needs of its business.

a. What is Howard's accumulated taxable income?

b. What is Howard's accumulated earnings tax liability?

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Global Taxation How Modern Taxes Conquered The World

ISBN: 9780192897572

1st Edition

Authors: Philipp Genschel, Laura Seelkopf