Sarah and Rex formed SR Entity on December 28 of last year. The entity operates on a

Question:

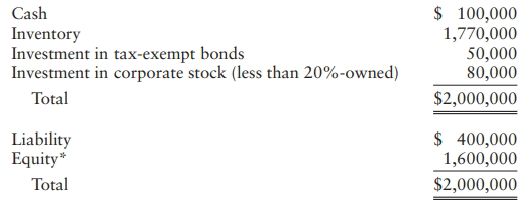

Sarah and Rex formed SR Entity on December 28 of last year. The entity operates on a calendar tax year. Each individual contributed $800,000 cash in exchange for a 50% ownership interest in the entity (common stock if a corporation; partnership interest if a partnership). In addition, the entity borrowed $400,000 from the bank. The entity operates on a calendar yea r. On December 28 of last year, the entity used the $2 mill ion cash (contributions and loan) to purchase assets as indicated in the following balance sheet as of December 28 of last year:

*If a partnership, each partners beginning capital account is $800,000.

The balance sheet did not change between December 28 of last year and the beginning of the current year. Thus, the above balance sheet also represents the balance sheet at January 1 of the current year.

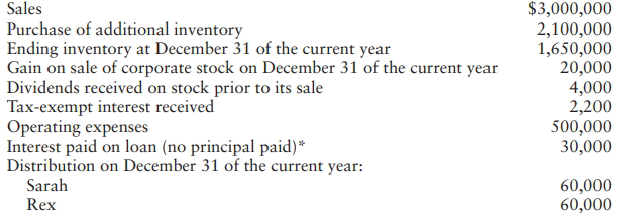

The following data apply to the entity for the current year:

*For simplicity, assume all the $30,000 interest expense pertains to business (and nor to investmems) .

Sarah and Rex actively manage the entity's business. At the individual level, Sarah and Rex are each single, and each individual claims a standard deduction. Neither individual has income from sources other than listed above.

a. First, assume the entity is a regular C corporation and the distributions are dividends to Sarah and Rex. For the current year, determine the following:

(1) The corporation's taxable income and tax liability.

(2) Sarah's and Rex's individual AGI, taxable income, and tax liability.

(3) The total tax liability for the corporation and its owners.

b. Next, assume the entity is a partnership. For the current year, determine the following:

(1) Partnership ordinary income and each partner's share of partnership ordinary income.

(2) Partnership separately stated items and each partner's share of each item.

(3) Sarah's and Rex's AGI, taxable income, and total tax liability. Assume each partner will incur a $17,660 self-employment tax on his or her share of partnership ordinary income, and each partner will claim the qualified business income (QBI) deduction.

(4) Each partner's basis in the partnership (outside basis) at the end of the current year.

c. Based on your analysis for the current year, which entity is better from an overall tax perspective? What are the shortcomings of examining only one year?

d. Given the corporate form, explain how the corporation can restructure the $60,000 distribution to each individual to reduce the overall tax liability. Assume the corporation and each individual pay a 7.65% payroll tax.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Partnership

A legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer:

Global Taxation How Modern Taxes Conquered The World

ISBN: 9780192897572

1st Edition

Authors: Philipp Genschel, Laura Seelkopf