Consider an airlines company that has to purchase oil regularly (say, every three months) for its operations.

Question:

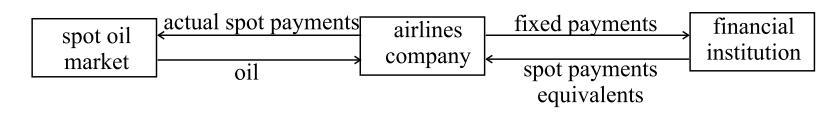

Consider an airlines company that has to purchase oil regularly (say, every three months) for its operations. To avoid the fluctuation of oil prices on the spot market, the company may wish to enter into a commodity swap with a financial institution. The following schematic diagram shows the flows of payment in the commodity swap:

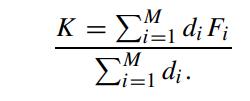

Under the terms of the commodity swap, the airline company receives spot price for a certain number units of oil at each swap date while paying a fixed amount K per unit. Let ti, i = 1, 2, ··· ,M, denote the swap dates and di be the discount factor at the swap initiation date for cash received at ti. Let Fi denote the forward price of one unit of oil to be received at time ti, and K be the fixed payment per unit paid by the airline company to the swap counterparty. Suppose K is chosen such that the initial value of the commodity swap is zero, show that

That is, the fixed rate is a weighted average of the prices of the forward contracts maturing on the swap dates with the corresponding discount factors as weights.

Step by Step Answer: