Suppose two financial institutions X and Y are faced with the following borrowing rates Suppose X wants

Question:

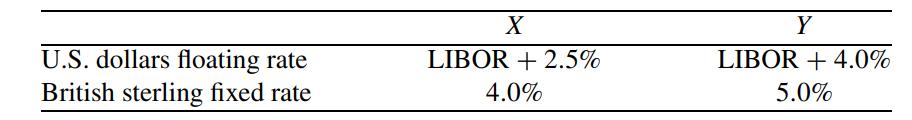

Suppose two financial institutions X and Y are faced with the following borrowing rates

Suppose X wants to borrow British sterling at a fixed rate and Y wants to borrow U.S. dollars at a floating rate. How can a currency swape be arranged that benefits both parties.

Transcribed Image Text:

U.S. dollars floating rate British sterling fixed rate X LIBOR + 2.5% 4.0% Y LIBOR + 4.0% 5.0%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (4 reviews)

In a currency swap two parties agree to exchange cash flows in different currencies for a specified period of time The goal is usually to benefit from ...View the full answer

Answered By

Muhammad Ghyas Asif

It is my obligation to present efficient services to my clients by providing a work of quality, unique, competent and relevant. I hope you have confidence in me and assign me the order and i promise to follow all the instructions and keep time.

4.60+

109+ Reviews

203+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

The investment banker helping Hologen with the Cybertech acquisition had done some preliminary research and concluded that Hologen could raise $200 million dollars by issuing a 5% coupon bond (paid...

-

Gold has served as a medium of exchange and a store of value. The increase in trade led each country to set a par value for its currency in terms of gold. The gold standard as an international...

-

Hedging with Swaps and Futures Mocsaro wants to invest in Saudi-Arabia. The company needs 10.0 Mio. SAR (Saudi Arabia Riyal) for the investment. First contacts with Saudi-Arabian Banks brought up...

-

Prove that the curves y 2 = 4x and x 2 = 4y divide the by of the squre bounded by x = 0, x = 4, y = 4 and y = 0 into three equal parts.

-

Walmart does very well when the economy turns sour. How can it protect itself when the economy is on the rise? Explain.

-

Several items are omitted from the income statement and cost of goods manufactured statement data for two different companies for the month of December 2014: Instructions 1. Determine the amounts of...

-

Epic Systems is a Wisconsin health care software company. In 2014, Epic introduced a company policy that required employees to use individual arbitration in any disputes. Jacob Lewis, an Epic...

-

Byrd Company produces one product, a putter called GO-Putter. Byrd uses a standard cost system and determines that it should take one hour of direct labor to produce one GO-Putter. The normal...

-

A figure skater spins at the end of her routine and slows down with an angular acceleration of "0.4" A per second squared. If she initially spun with a frequency of 2.35 Hz, how much time does it...

-

Consider an airlines company that has to purchase oil regularly (say, every three months) for its operations. To avoid the fluctuation of oil prices on the spot market, the company may wish to enter...

-

Consider an interest rate swap of notional principal $1 million and remaining life of nine months, the terms of the swap specify that six-month LIBOR is exchanged for the fixed rate of 10% per annum...

-

Franois plans to invest $4,000 in an individual savings account (ISA) at a nominal interest rate of 6%. a. How much will Franois have in the account after 10 years if interest is compounded (1)...

-

The fund balance category that requires formal action of the highest level decision-making body of a government is a. assigned fund balance. b. committed fund balance. c. nonspendable fund balance....

-

The proceeds of a federal grant made to assist in financing the future construction of an adult training center should be recorded in a. the General Fund. b. a Special Revenue Fund. c. a Capital...

-

General budgets are most common for which of the following funds? a. General Fund. b. Special Revenue Fund. c. Permanent Fund. d. All of the above. e. Items a and b only. I f. Items a and c only.

-

What amount of net assets released from restrictions should the ONPO in question 8 report in its Statement of Activities for 20X6? a. $0 b. $800,000 c. $1,100,000 d. $2,000,000

-

Which of the following statements is false? a. Generally Accepted Accounting Principles (GAAP) dictate the basis of budgeting for all governmental funds. b. Zero-base budgeting (ZBB) is an acceptable...

-

Explain the difference in intended application between strategic pricing and life-cycle costing.

-

The age-old saying for investing is "buy low and sell high," but this is easier said than done. Investors who panic about falling prices sell their investments, which in turn lowers the price and...

-

Are the benefits and limitations of a canned presentation any different if it is supported with a Power- Point presentation or DVD than if it is just a person talking? Why or why not?

-

How would our economy operate if personal salespeople were outlawed? Could the economy work? If so, how? If not, what is the minimum personal selling effort necessary? Could this minimum personal...

-

Franco Welles, sales manager for Nanek, Inc., is trying to decide whether to pay a sales rep for a new territory with straight commission or a combination plan. He wants to evaluate possible plansto...

-

During tax preparation the volunteer notices the taxpayer's type of income is out of VITA/TCE scope per Publication 4012. The volunteer refers the taxpayer to their sister's tax preparation services....

-

* The carrying value of these debentures is 103 while the face value is 100. The company marks these debentures to market each period because the debentures are hedged with interest-rate swaps. The...

-

Provide a brief history of Mississauga, Ontario, Canada on the First Peoples territory. What was Mississauga called before it was given a European name? Is there a treaty and if so, who were the...

Study smarter with the SolutionInn App