Consider an American installment option in which the buyer pays a smaller upfront premium, while a constant

Question:

Consider an American installment option in which the buyer pays a smaller upfront premium, while a constant stream of installments at a certain rate per unit time are paid subsequently throughout the whole life of the option. Let δ denote the above rate of installment flow. The holder has the right to exercise the option or stop the installment payment prematurely.

(a) Derive the linear complementarity formulation of an American installment option on a dividend yield paying asset with either a call or put payoff.

(b) Consider an American installment call option and let q > 0 denote the dividend yield. Show that the optimal stopping boundaries consist of two branches:

(i) The upper critical asset price S∗up(t) at which the option should be exercised prematurely.

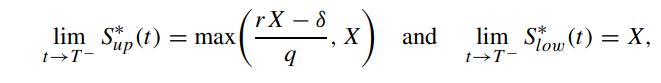

(ii) The lower critical asset price S∗low(t) at which the option should be terminated prematurely by stopping the installment payment. Show that

where X is the strike price.

where X is the strike price.

(c) Deduce similar results for an American installment option with the put payoff.

Step by Step Answer: