Suppose the underlying asset is paying a continuous dividend yield at the rate q, the two governing

Question:

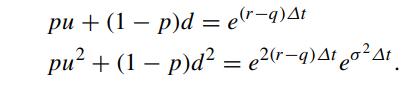

Suppose the underlying asset is paying a continuous dividend yield at the rate q, the two governing equations for u,d and p are modified as

Show that the parameter values in the binomial model are modified by replacing the growth factor of the asset price erΔt (under the risk neutral measure) by the new factor e(r−q)Δt while the discount factor in the binomial formula remains to be e−rΔt .

Transcribed Image Text:

pu + (1 - p)d = e(r-q)4t pu² + (1 - p)d² = ²(r-q)Ato² At

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

In the binomial model the parameters u d and p are determined by the following e...View the full answer

Answered By

JAPHETH KOGEI

Hi there. I'm here to assist you to score the highest marks on your assignments and homework. My areas of specialisation are:

Auditing, Financial Accounting, Macroeconomics, Monetary-economics, Business-administration, Advanced-accounting, Corporate Finance, Professional-accounting-ethics, Corporate governance, Financial-risk-analysis, Financial-budgeting, Corporate-social-responsibility, Statistics, Business management, logic, Critical thinking,

So, I look forward to helping you solve your academic problem.

I enjoy teaching and tutoring university and high school students. During my free time, I also read books on motivation, leadership, comedy, emotional intelligence, critical thinking, nature, human nature, innovation, persuasion, performance, negotiations, goals, power, time management, wealth, debates, sales, and finance. Additionally, I am a panellist on an FM radio program on Sunday mornings where we discuss current affairs.

I travel three times a year either to the USA, Europe and around Africa.

As a university student in the USA, I enjoyed interacting with people from different cultures and ethnic groups. Together with friends, we travelled widely in the USA and in Europe (UK, France, Denmark, Germany, Turkey, etc).

So, I look forward to tutoring you. I believe that it will be exciting to meet them.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

A different European put has strike price K = $35 and expires in 30 days. The underlying asset is currently selling for S = $33 . The yearly volatility of the underlying is estimated to be = 0.42,...

-

KYC's stock price can go up by 15 percent every year, or down by 10 percent. Both outcomes are equally likely. The risk free rate is 5 percent, and the current stock price of KYC is 100. (a) Price a...

-

The Internet has evolved over the years and companies need to keep up with the technologies driving this evolution in order to stay current. Do you think that companies should continue to change...

-

Page ranks. Design a graph in which the highest-ranking page has fewer links pointing to it than some other page.

-

EXPANDED STATEMENT OF CASH FLOWS Financial statements for McDowell Company as well as additional information relevant to cash flows during the period are given below and on page 914. Additional...

-

A and B face the choice of working in a safe mine at $200/wk or an unsafe mine at $300/wk. The wage differential between the two mines reflects the costs of the safety equipment in the safe mine. The...

-

In February 2007, The Elliot Group, Inc., an Illinois real estate developer, made a deal with the Village of Arlington Heights to develop property in that village. Arlington Market, LLC, was...

-

In the United States, accounting for pensions has received a great deal of attention. In other countries, pension accounting is given much less attention. In one page, examine the reasons that would...

-

8) What does the following method do? Rewrite it so it produces the same results but does not use recursion. public static boolean whoKnows (int arr, int i, int j) { if (i >= j) { return true; } else...

-

Show that Note that By considering the Taylor expansion of n(p ln u/d + ln d) and np (1 p)(ln u/d) 2 in powers of t, show that where nt = . lim (n, k, p') = N(d) n where p' =ue ueratp and d = In...

-

Consider an American installment option in which the buyer pays a smaller upfront premium, while a constant stream of installments at a certain rate per unit time are paid subsequently throughout the...

-

Weiss Company prepares monthly cash budgets. Relevant data from operating budgets for 2013 are: All sales are on account. Collections are expected to be 60% in the month of sale, 30% in the first...

-

Your client invested $10,000 in an interest bearing promissory note earning an 11% annual rate of interest, compounded monthly. How much will the note be worth at the end of 7 years, assuming that...

-

Exhibit 14.4 The current stock price of ABC Corporation is $53.50. ABC Corporation has the following put and call option prices that expire six months from today. The risk-free rate of return is 5...

-

The flaw of averages refers to 1 the average of a measure (e.g., profit) only provides a small indication of system behavior. 2 setting random input values to their average or best guess values can...

-

The IRS examines the 20X5 tax return of Sam Short. His return reported tax due in the amount of $60,000. The revenue agent has determined that Sam understated his tax for 20X5 by $22,000 and is...

-

Find the power consumed by a 120-V device that draws 2.0 A of current?

-

It seems logical that restaurant chains with more units (restaurants) would have greater sales. This assumption is mitigated, however, by several possibilities: some units may be more profitable than...

-

suppose a nickel-contaminated soil 15 cm deep contained 800 mg/kg Ni, Vegetation was planted to remove the nickel by phytoremediation. The above-ground plant parts average 1% Ni on a dry-weight bas...

-

Is Instacarts model for selling online groceries viable? Why or why not?

-

What is the role of m-commerce in business, and what are the most important m-commerce applications?

-

Assess the management, organization, and technology issues for using social media to engage with customers.

-

Consider the Bertrand duopoly discussed in class. Assume each firm has constant marginal cost c = 10 and zero fixed cost. Each firm chooses a price Pi 0. The market demand is given by Q = 130 P,...

-

II. The Table below gives an individual's MUx and MUy schedule. Suppose X and Y are the only two commodities available and Px = P2 while Py = P1. The individual's income is P12 and is all spent. Q...

-

3. Consider a two period problem where a consumer has preferences over consumption in the two periods given by: log c + Blog c'. She has no initial assets and has income y in the first period y' in...

Study smarter with the SolutionInn App