Consider the exchange option that gives the holder the right but not the obligation to exchange risky

Question:

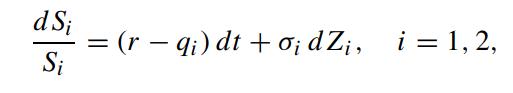

Consider the exchange option that gives the holder the right but not the obligation to exchange risky asset S2 for another risky asset S1. Let the price dynamics of S1 and S2 under the risk neutral measure be governed by

where dZ1 dZ2 = ρdt. Let V (S1,S2,τ) denote the price function of the exchange option, whose terminal payoff takes the form

![]()

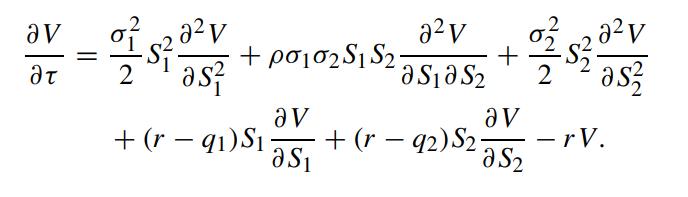

Show that the governing equation for V (S1,S2,τ) is given by

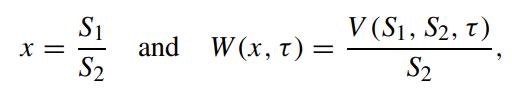

By taking S2 as the numeraire and defining the similarity variables:

By taking S2 as the numeraire and defining the similarity variables:

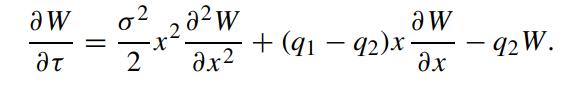

show that the governing equation for W(x,τ) becomes

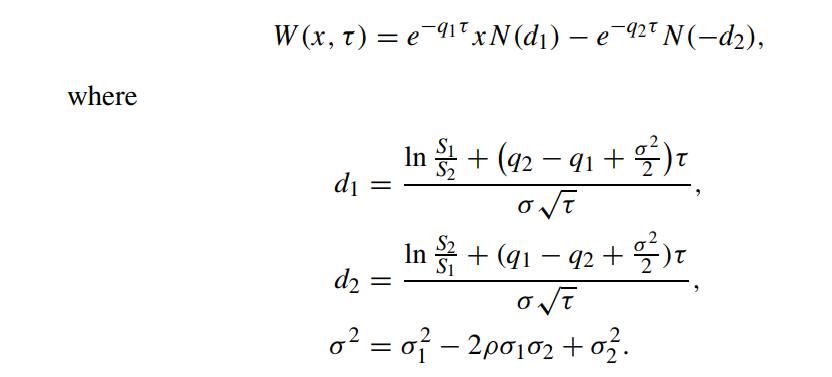

Verify that the solution to W(x,τ) is given by

Verify that the solution to W(x,τ) is given by

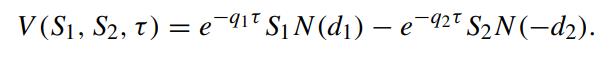

Referring to the original option price function V (S1,S2,τ), we obtain

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: