From the BlackScholes price function c(S,) for a European vanilla call, show that the limiting values of

Question:

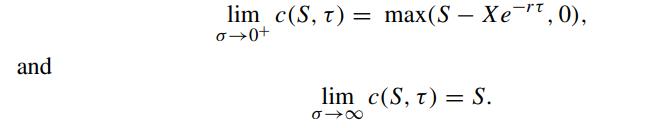

From the Black–Scholes price function c(S,τ) for a European vanilla call, show that the limiting values of the call price at vanishing volatility and infinite volatility are the lower and upper bounds of the European call price respectively, namely,

Give an appropriate financial interpretation of the above results. Apparently, X does not appear in c(S,τ) when σ → ∞. Is it justifiable based on financial intuition?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: