Show that when a European option is currently out-of-the-money, then higher volatility of the asset price or

Question:

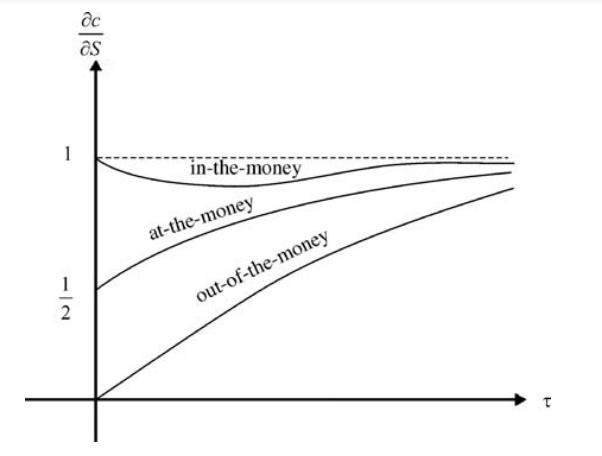

Show that when a European option is currently out-of-the-money, then higher volatility of the asset price or longer time to expiry makes it more likely for the option to expire in-the-money. What would be the impact on the value of delta? Do we have the same effect or opposite effect when the option is currently inthe-money? Also, give the financial interpretation of the asymptotic behavior of the delta curves in Fig. 3.4 at the respective limit τ → 0+ and τ → ∞.

Fig. 3.4

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: