Let p(S,M,t) denote the price function of the European floating strike lookback put option. Define x =

Question:

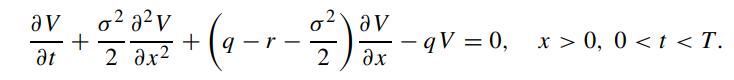

Let p(S,M,t) denote the price function of the European floating strike lookback put option. Define x = ln M/S and V (x,t) = p(S,M,t)/S. The pricing formulation of V (x,t) is given by

The final and boundary conditions are

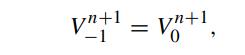

Suppose the boundary condition at x = 0 is approximated by

Suppose the boundary condition at x = 0 is approximated by

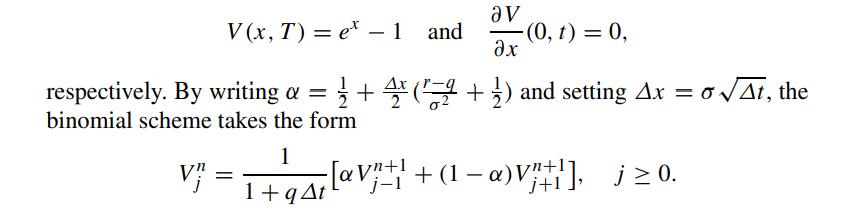

then the numerical boundary value is given by

![V = 1 1+q ' -[a Vn+ + (1 - ) V]. 0](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/5/7/1/833655caab9ddfe51700571830968.jpg)

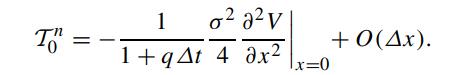

Let T0n denote the local truncation error at j = 0 of the above binomial scheme, show that

Therefore, the proposed binomial scheme is not consistent.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: