Suppose the dynamics of the short rate r(t) is governed by the governing differential equation for the

Question:

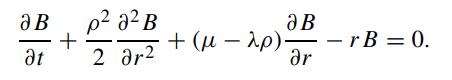

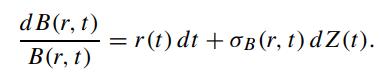

Suppose the dynamics of the short rate r(t) is governed by

![]()

the governing differential equation for the price of a zero coupon bond B(r,t) is given by [see (7.2.8)] the governing differential equation for the price of a zero coupon bond B(r,t) is given by [see (7.2.8)]

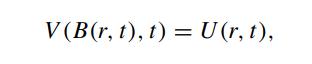

For any noncoupon bearing paying claim whose payoff depends on r(T ), its price function U(r,t) is governed by the same differential equation as above. Now, suppose we relate the price of the claim to the bond price by defining

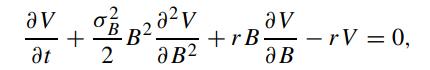

show that V (B,t) satisfies

where the volatility of bond returns σB is given by

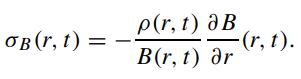

Suppose the claim’s payoff is f (BT ) at maturity T , by applying the Feynman– Kac Theorem, show that V (B,t) admits the following representation

Suppose the claim’s payoff is f (BT ) at maturity T , by applying the Feynman– Kac Theorem, show that V (B,t) admits the following representation

![= EQ[e- r(a)du f (B) |B = B] Bt V(B, t) = Ege](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/5/7/4/250655cb42adf7c41700574248104.jpg)

where the measure Q is defined so that

Step by Step Answer: