Suppose we define the flexible geometric average G F (n) of asset prices at n evenly spaced

Question:

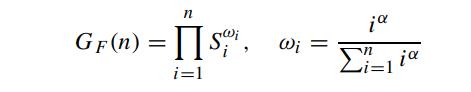

Suppose we define the flexible geometric average GF (n) of asset prices at n evenly spaced time instants by

and Si is the asset price at time ti. Here, ωi is the weighting factor associated with Si. Note that the larger the value of α, the heavier are the weights allocated to the more recent asset price. Under the risk neutral measure, the asset price is assumed to follow the Geometric Brownian process

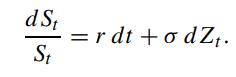

and Si is the asset price at time ti. Here, ωi is the weighting factor associated with Si. Note that the larger the value of α, the heavier are the weights allocated to the more recent asset price. Under the risk neutral measure, the asset price is assumed to follow the Geometric Brownian process

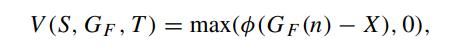

We consider the fixed strike Asian option with terminal payoff

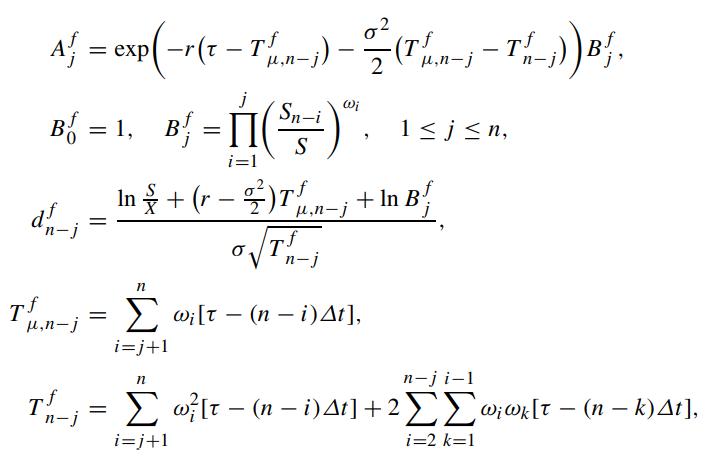

where X is the strike price, and ∅ is the binary variable which is set to 1 for a call or −1 for a put. Show that the Asian option value is given by (Zhang, 1994)

![V(S, GF, t) = 0 = 0 [SA/N (0 (d_ + 0 T' _; })) - XeN (d-;)] -j -j where](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/5/4/3/967655c3ddfb0f6e1700543965809.jpg)

n is the number of asset prices taken for averaging, Δt is the time interval between successive observational instants, j is the number of observations already passed, Bfj can be considered as the weighted average of the returns of those observations that have already passed.

Step by Step Answer: