The holder of a European in-the-money call option may suffer loss in profits if the asset price

Question:

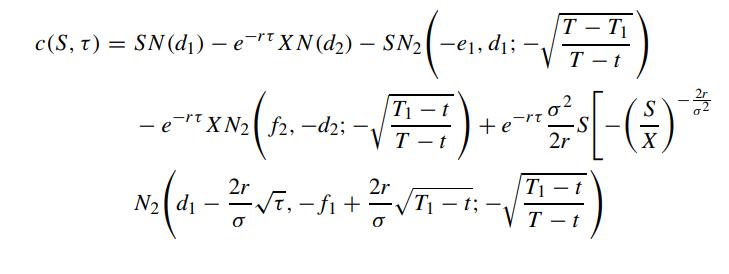

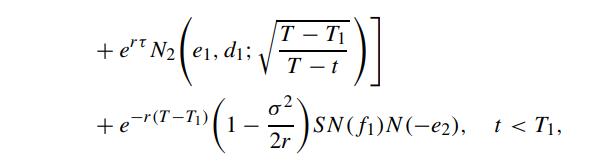

The holder of a European in-the-money call option may suffer loss in profits if the asset price drops substantially just before expiration. The “limited period” fixed strike lookback feature may help remedy that holder’s market exit problem. To achieve an optimal timing for market exit, it is sensible to choose the lookback period starting some time after the option’s starting date and ending at expiration. Let [T1,T ] denote the lookback period and consider the pricing of this fixed strike lookback call at time t before the lookback period, with terminal payoff: max(MTT1 −X, 0). Note that when ST1 > X, the call is guaranteed to be in-the-money at expiration since MTT1 ≥ ST1 . Show that the price of the European “limited-period” lookback call option is given by

![c(S, 7) = e Eq[max (MT, X, 0)] MT -rt + er o [{Sn (MH ) - X} 1m, >xX.Si, X,ST STI + e TEQ[{ST (M) - X}1ST,](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/4/8/6/720655b5e409a0641700486711766.jpg) where expectation is taken under the risk neutral measure Q and X is the strike price. Assuming the usual Geometric Brownian process for the asset price under Q, show that

where expectation is taken under the risk neutral measure Q and X is the strike price. Assuming the usual Geometric Brownian process for the asset price under Q, show that

where d1,e1,f1, ··· , etc. are the same as those defined in (4.2.16) except that m is replaced by X accordingly (Heynen and Kat, 1994b). Deduce the price formula of the corresponding “limited period” fixed strike lookback put option whose terminal payoff function is max(X − mTT1 , 0).

Step by Step Answer: