The terminal payoff of the lookback spread option is given by Show that the price of the

Question:

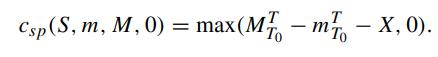

The terminal payoff of the lookback spread option is given by

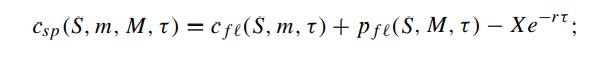

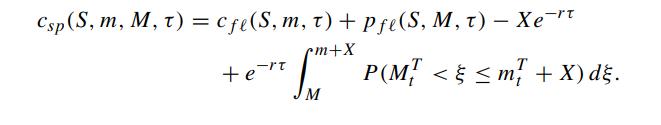

Show that the price of the European lookback spread option can be expressed as (Wong and Kwok, 2003)

(i) currently at- or in-the-money, that is, M − m − X ≥ 0

(ii) currently out-of-the-money, that is, M − m − X

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: