Prove the following put-call parity relation between the prices of the fixed strike lookback call and floating

Question:

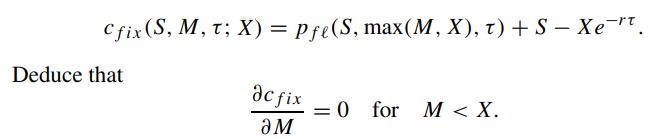

Prove the following put-call parity relation between the prices of the fixed strike lookback call and floating strike lookback put:

Give a financial interpretation why cfix is insensitive to M when M

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

The putcall parity for a fixed strike lookback call cfix and a floating strike lookback put pfl is given by cfixS M t X pflS maxM X t S Xert Where cfi...View the full answer

Answered By

Sufiyan Alam

Hi! I am Sufiyan Alam and I have been mentoring students physics and mathematics from the last 7 years. I have done my M.tech in Automotive Technology from College of Engineering, Pune, India. When I was a student myself, I was curious to know the fundamentals of the working principles that govern the whole universe. This curiosity motivated me to pursue my career in the evolving technology. Being a mentor, I understand how to break down the complex problems into its basics.

0.00

0 Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

The holder of a European in-the-money call option may suffer loss in profits if the asset price drops substantially just before expiration. The limited period fixed strike lookback feature may help...

-

Deduce the following put-call parity relation between the prices of European fixed strike Asian call and put options under continuously monitored geometric averaging c(S, G, t) - P(S, G, t) -r(T-1)...

-

Show that the put-call parity relations between the prices of floating strike and fixed strike Asian options at the start of the averaging period are given by By combining the above put-call parity...

-

Brian Caldwell and Adriana Estrada have operated a successful firm for many years, sharing net income and net losses equally. Kris Mays is to be admitted to the partnership on September 1 of the...

-

The final step in DNA synthesis is deprotection by treatment with aqueous ammonia. Show the mechanisms by which deprotection occur at the points indicated in the followingstructure: . DMTO N. 'N'...

-

On January 1, 2010, Pam Company purchased an 85% interest in Shaw Company for $540,000. On this date, Shaw Company had common stock of $400,000 and retained earnings of $140,000. An examination of...

-

Using the density function of the stopping time probability for a fixed \(\lambda\), find the average time to the first event over the entire interval \([0, \infty)\).

-

The Las Angeles Times regularly reports the air quality index for various areas of Southern California. A sample of air quality index values for Pomona provided the following data: 28, 42, 58, 48,...

-

1. Do you believe that Porshe's management is appropriately concerned with shareholder wealth? Does Porsche's ownership structure work to the benefit or detriment of public shareholders?

-

Suppose we use a straddle (combination of a call and a put with the same strike m) in the rollover strategy for hedging the floating strike lookback call and write Find an integral representation of...

-

The terminal payoff of the lookback spread option is given by Show that the price of the European lookback spread option can be expressed as (Wong and Kwok, 2003) (i) currently at- or in-the-money,...

-

Consider a hypergeometric probability distribution with n = 3, R = 5, and N = 9. Calculate the following probabilities: a. P(x = 0) b. P(x > 1) c. P(x < 3) d. Calculate the mean and standard...

-

Can you explain the principles of synthetic biology approaches for engineering artificial gene circuits and genetic networks, and discuss their potential applications in biotechnology, medicine, and...

-

1. What is the value of the following investments in the future? (show your work):+ a) $6,000 invested for 5 years at 16% compounded quarterly?+ b) $9,000 invested for 7 years at 8% compounded...

-

Credenza Industries is expected to pay a dividend of $1.05 at the end of the coming year. It is expected to sell for $63 at the end of the year. If its equity cost of capital is 9%, what is the...

-

CCC currently has sales of $22,000,000 and projects sales of $27,500,000 for next year. The firm's current assets equal $8,000,000 while its fixed assets are $9,000,000. The best estimate is that...

-

How do non-coding RNAs such as circular RNAs (circRNAs) and transfer RNAs (tRNAs) participate in gene regulation and cellular processes beyond their canonical roles, and what are the implications of...

-

Look again at the valuation in Table of the option to invest in the Mark II project. Consider a change in each of the following inputs. Would the change increase or decrease the value of the...

-

Rowland Textile Inc. manufactures two products: sweatshirts and T-shirts. The manufacturing process involves two activities: cutting and sewing. Expected overhead costs and cost drivers are as...

-

What are the current trends in computer hardware platforms? a. Describe the evolving mobile platform, quantum computing, and cloud computing. b. Explain how businesses can benefit from...

-

What are the challenges of managing IT infrastructure and management solutions? a. Name and describe the management challenges posed by IT infrastructure. b. Explain how using a competitive forces...

-

What are the problems of managing data resources in a traditional file environment? a. List and describe each of the components in the data hierarchy. b. Define and explain the significance of...

-

2. The three solutions of the depressed cubic equation x- px -q = 0 are given by 2 1/3 2k i 1/3 2kT i -- (+0'-')"-"-(-0'-*)-* 2 e 2 for k 0, 1, 2. If p = 3 2-18 and q = 2, the only real root is ro...

-

A principal amount of $5,000 is placed in a savings account with 5% annual interest compounded quarterly. Part A: List the total account balances for years 0 through 4. Show all necessary work. (2...

-

discuss the relationship between symbolic imagery and psychoanalytic theory, particularly in relation to the exploration of unconscious desires, fears, and societal taboos within literature ?

Study smarter with the SolutionInn App