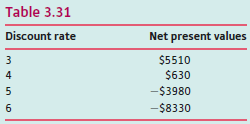

A company has the option of investing in a project and calculates the net present values shown

Question:

A company has the option of investing in a project and calculates the net present values shown in Table 3.31 at four different discount rates. (a) Estimate the internal rate of return of the project.

(a) Estimate the internal rate of return of the project.

(b) If the money could be invested elsewhere at 5.5% interest, explain whether you would advise the company to invest in this project.

Internal Rate of Return of IRR is a capital budgeting tool that is used to assess the viability of an investment opportunity. IRR is the true rate of return that a project is capable of generating. It is a metric that tells you about the investment...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: