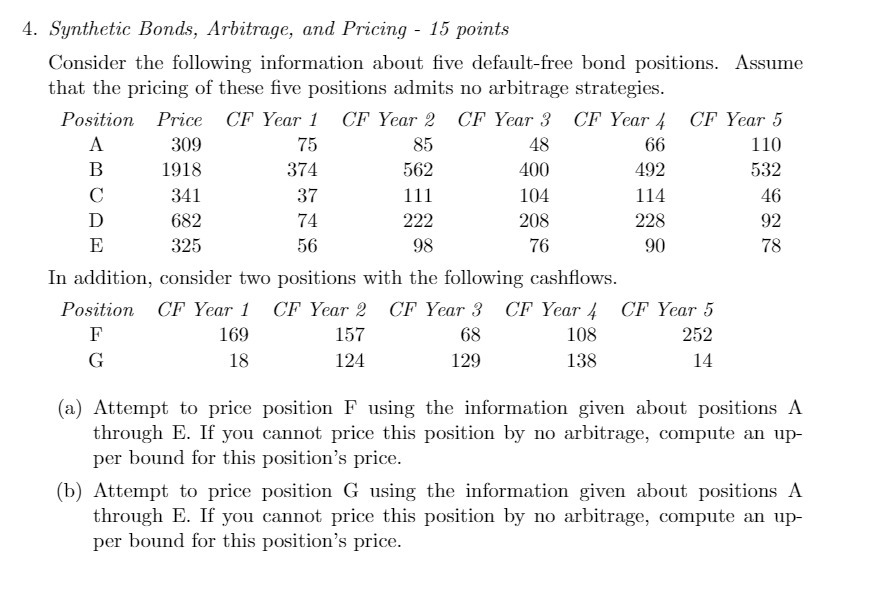

Question: 4. Synthetic Bonds, Arbitrage, and Pricing 15 points Consider the following information about five default-free bond positions. Assume that the pricing of these five

4. Synthetic Bonds, Arbitrage, and Pricing 15 points Consider the following information about five default-free bond positions. Assume that the pricing of these five positions admits no arbitrage strategies. Position Price CF Year 1 CF Year 2 CF Year 3 CF Year 4 CF Year 5 A 309 75 85 48 66 110 B 1918 374 562 400 492 532 C 341 37 111 104 114 46 682 74 222 208 228 92 E 325 56 98 76 90 78 In addition, consider two positions with the following cashflows. Position CF Year 1 CF Year 2 CF Year 3 CF Year 4 CF Year 5 F G 169 18 157 124 68 129 108 138 252 14 (a) Attempt to price position F using the information given about positions A through E. If you cannot price this position by no arbitrage, compute an up- per bound for this position's price. (b) Attempt to price position G using the information given about positions A through E. If you cannot price this position by no arbitrage, compute an up- per bound for this position's price.

Step by Step Solution

3.27 Rating (147 Votes )

There are 3 Steps involved in it

To determine the price of position F and position G we can use the principle of no arbitrage If there are no arbitrage opportunities the price of a po... View full answer

Get step-by-step solutions from verified subject matter experts