In 2014, the U.S. House of Representatives approved a new farm bill establishing the Margin Protection Program

Question:

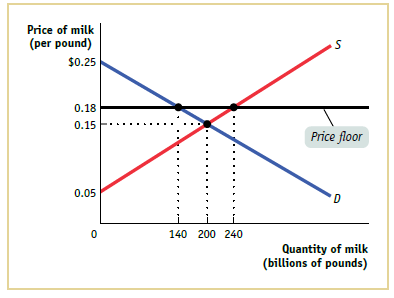

a. In the absence of a price floor, how much consumer surplus is created? How much producer surplus? What is the total surplus (producer surplus plus consumer surplus)?

b. With the price floor at $0.18 per pound of milk, consumers buy 140 billion pounds of milk. How much consumer surplus is created now?

c. With the price floor at $0.18 per pound of milk, producers sell 240 billion pounds of milk (some to consumers and some to the USDA). How much producer surplus is created now?

d. How much money does the USDA spend to buy surplus milk?

e. Taxes must be collected to pay for the purchases of surplus milk by the USDA. As a result, total surplus is reduced by the amount the USDA spent buying surplus milk. Using your answers from parts b, c, and d, what is the total surplus when there is a price floor? How does this total surplus compare to the total surplus without a price floor from part a?

Step by Step Answer: