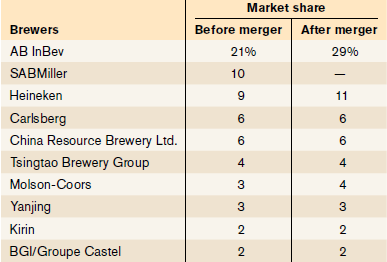

In 2015, Anheuser-Busch InBev offered $104.2 billion to acquire SABMiller. The U.S. Justice Department approved the merger,

Question:

a. Using the table, calculate the HHI for the global beer market both before and after the merger.

b. Based on the HHI calculated in part a, how has the market structure for the global beer industry changed?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: