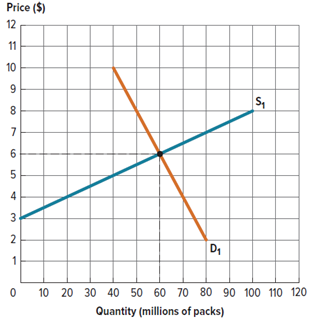

Suppose the government is considering taxing cigarettes. Because it is often politically more popular to tax the

Question:

a. Draw the after-tax supply curve if the government chooses to tax cigarette producers $2.50 per pack of cigaretters.

b. Plot the after-tax price paid by consumers and the after-tax price received by sellers.

c. Do consumers or producers bear the greater burden of this tax?

d. Now suppose the government consider taxing the consumers of cigarettes instead of the producers of cigarettes. Draw the after-tax supply curve if the government chooses to tax cigarette consumers $2.50 per pack of cigarettes.

e. Plot the after-tax price paid by consumers and the after-tax price received by sellers.

f. Do consumers or producers bear the greater burden of this tax?

g. Is the price sellers receive when the government taxes consumers of cigarettes more than, less than, or the same as the price sellers receive when the government producers of cigarettes?

Figure 6P-7:

Step by Step Answer: