(a) Assume that Blake is a public company and the number of shares held by Blake is...

Question:

(a) Assume that Blake is a public company and the number of shares held by Blake is enough to give it significant influence over Stergis. Prepare all the journal entries that Blake should make regarding this investment in Year 5 and Year 6. Also, state the disclosure requirements for Year 6 pertaining to Blake's investment in Stergis.

(b) Assume that Blake is a private company. Even though it has significant influence, it chose to use the cost method to account for its investment. Prepare all the journal entries that Blake should make regarding this investment in Year 5 and Year 6.

(c) If Blake wants to show the lowest debt-to-equity ratio at the end of Year 6, would it prefer to use the cost or equity method to report its investment in Stergis? Briefly explain.

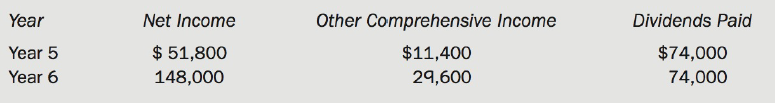

On January 1, Year 5, Blake Corporation purchased 25% of the outstanding common shares of Stergis Limited for $1,850,000.

The following relates to Stergis since the acquisition date:

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Modern Advanced Accounting in Canada

ISBN: 978-1259087554

8th edition

Authors: Hilton Murray, Herauf Darrell