Bolero Company holds 80 percent of the common stock of Rivera, Inc., and 40 percent of this

Question:

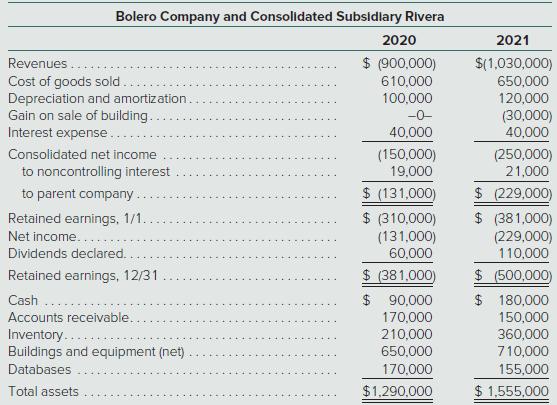

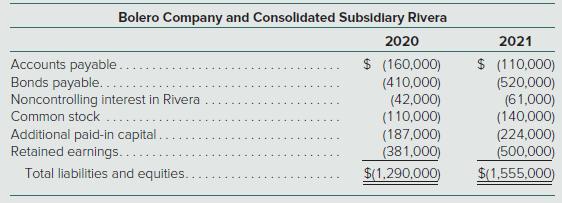

Bolero Company holds 80 percent of the common stock of Rivera, Inc., and 40 percent of this subsidiary’s convertible bonds. The following consolidated financial statements are for 2020 and 2021 (credit balances indicated by parentheses):

Additional Information for 2021

∙ The parent issued bonds during the year for cash.

∙ Amortization of databases amounts to $15,000 per year.

∙ The parent sold a building with a cost of $80,000 but a $40,000 book value for cash on May 11.

∙ The subsidiary purchased equipment on July 23 for $205,000 in cash.

∙ Late in November, the parent issued stock for cash.

∙ During the year, the subsidiary paid dividends of $10,000. Both parent and subsidiary pay dividends in the same year as declared.

Prepare a consolidated statement of cash flows for this business combination for the year ending December 31, 2021. Use the indirect method to compute cash flow from operating activities.

Bolero Company and Consolidated Subsidlary Rivera 2020 2021 $ (900,000) $(1,030,000) 650,000 120,000 (30,000) 40,000 Revenues... Cost of goods sold. Depreciation and amortization. Gain on sale of building. Interest expense.. 610,000 100,000 -0- 40,000 Consolidated net income (150,000) 19,000 (250,000) 21,000 to noncontrolling interest $ (131,000) $ (310,000) (131,000) 60,000 $ (381,000) $ 90,000 $ 229,000) $ (381,000) (229,000) 110,000 to parent company.. Retained earnings, 1/1.. Net income... Dividends declared. $ 500,000) $ 180,000 Retained earnings, 12/31 Cash.... Accounts receivable. 170,000 150,000 Inventory.. Buildings and equipment (net) 210,000 360,000 710,000 155,000 650,000 Databases 170,000 Total assets $1,290,000 $ 1,555,000

Step by Step Answer:

BOLERO COMPANY AND CONSOLIDATED SUBSIDIARY RIVERA Consolidated Statement of Cash Flows Year Ending December 31 2021 CASH FROM OPERATING ACTIVTIES Cons...View the full answer

Advanced Accounting

ISBN: 9781260247824

14th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik

Related Video

In order to determine the amount of cash created by operating operations, the indirect technique for preparing the statement of cash flows entails adjusting net income with changes in balance sheet.

Students also viewed these Business questions

-

Rodriguez Company holds 80 percent of the common stock of Molina, Inc., and 30 percent of this subsidiary's convertible bonds. The following consolidated financial statements are for 2012 and 2013:...

-

Rodriguez Company holds 80 percent of the common stock of Molina, Inc., and 30 percent of this subsidiarys convertible bonds. The following consolidated financial statements are for 2010 and 2011:...

-

Compute net cash flow from operating activities for Tulsa Corporation under the indirect reporting format. Tulsa Corporation provided you with the following information for the current year. Compute...

-

(1.0.5) (2, 2) (1,0) lim f(x) #-1+ For this part, no explanation is needed. Use the graph to calculate the limits: (2,1) lim f(x) 2-2+ lim f(x) 2-1 For this part, no explanation is needed. Use the...

-

The orbital diagram that follows shows the valence electrons for a 2+ ion of an element. (a) What is the element? (b) What is the electron configuration of an atom of this element? 4d

-

The prices of zero-coupon bonds with various maturities are given in the following table. Suppose that you want to construct a 2-year maturity forward loan commencing in 3 years. The face value of...

-

Unless needed for screening purposes, why shouldn't demographic questions be asked up front in questionnaires?

-

Two billion times a day, Proctor & Gamble (P&G) brands touch the lives of people around the world. The company has one of the largest and strongest portfolios of trusted, quality brands, including...

-

Where did they get 8550 for patient days?? patients x days in month 95 x 30=2,850 not 8550. Monthly Food Cost Number of Patients Days in the month Patient Days PPD $16,356.00 95 30

-

In order to raise revenue to meet the increasing costs of government, a province and a territory each imposed a new tax on e-cigarettes. The legislation that the province enacted states: "Any person...

-

On January 1, 2020, Mona, Inc., acquired 80 percent of Lisa Companys common stock as well as 60 percent of its preferred shares. Mona paid $65,000 in cash for the preferred stock, with a call value...

-

On June 30, 2021, Plaster, Inc., paid $916,000 for 80 percent of Stucco Companys outstanding stock. Plaster assessed the acquisition-date fair value of the 20 percent noncontrolling interest at...

-

Explain why this reaction occurs with anti-Markovnikov regiochemistry: CI + CF,CH,CH CF;CH=CH2 + HCI

-

The wage rate is always determined by two factors: ________________and ___________.

-

On average, ________. a) people with professional degrees earn about twice as much as high school dropouts b) college graduates earn about four times as much as high school graduates c) Most high...

-

Which economist believes all profits are linked with uncertainty and risk? a) Frank Knight b) Joseph Schumpeter c) Karl Marx d) John Maynard Keynes.

-

The substitution effect (on the backward-bending labor supply curve) takes place when ___________.The income effect takes place when ____________.

-

Use Newton-Raphson to find a solution to the polynomial equation \(f(x)=y\) where \(y=0\) and \(f(x)=x^{3}+8 x^{2}+2 x-40\). Start with \(x(0)=1\) and continue until (6.2.2) is satisfied with...

-

Fish n'Fly sells an ultra-lightweight fishing rod that is considered to be one of the best fishing rods on the market. Information follows for Fish n'Fly's purchases and sales of the...

-

(a) Find the equation of the tangent line to f(x) = x 3 at the point where x = 2. (b) Graph the tangent line and the function on the same axes. If the tangent line is used to estimate values of the...

-

Many companies make annual reports available on their corporate Internet home page. Annual reports also can be accessed through the SEC's EDGAR system at www.sec.gov (under Filing Type, search for...

-

Many companies make annual reports available on their corporate Internet home page. Annual reports also can be accessed through the SEC's EDGAR system at www.sec.gov (under Filing Type, search for...

-

Moxie Corporation incurs research and development costs of $500,000 in 2013, 30 percent of which relates to development activities subsequent to certain criteria having been met that suggest that an...

-

Can you elucidate the intricacies of cellular respiration, delineating the metabolic pathways involved and their respective roles in energy production within eukaryotic organisms ?

-

How do the mechanisms of ventilation and gas exchange operate synergistically in facilitating the diffusion of oxygen and carbon dioxide across the respiratory membrane, ensuring optimal...

-

How do environmental factors, such as altitude, temperature, and atmospheric composition, influence respiratory physiology, necessitating adaptive responses at both the cellular and systemic levels...

Study smarter with the SolutionInn App