Boulder, Inc., obtained 90 percent of Rock Corporation on January 1, 2019. Annual amortization of $22,000 is

Question:

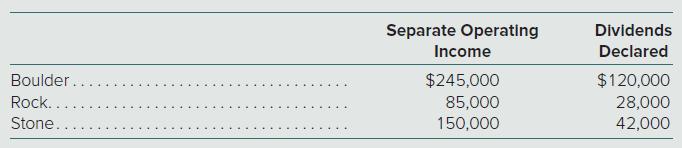

Boulder, Inc., obtained 90 percent of Rock Corporation on January 1, 2019. Annual amortization of $22,000 is applicable on the allocations of Rock’s acquisition-date business fair value. On January 1, 2020, Rock acquired 75 percent of Stone Company’s voting stock. Excess business fair-value amortization on this second acquisition amounted to $8,000 per year. For 2021, each of the three companies reported the following information accumulated by its separate accounting system. Separate operating income figures do not include any investment or dividend income.

a. What is consolidated net income for 2021?

b. How is consolidated net income distributed to the controlling and noncontrolling interests?

Step by Step Answer:

Advanced Accounting

ISBN: 9781260247824

14th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik