On January 1, 2019, Uncle Company purchased 80 percent of Nephew Companys capital stock for $500,000 in

Question:

On January 1, 2019, Uncle Company purchased 80 percent of Nephew Company’s capital stock for $500,000 in cash and other assets. Nephew had a book value of $600,000, and the 20 percent noncontrolling interest fair value was $125,000 on that date. On January 1, 2021, Nephew had acquired 30 percent of Uncle for $280,000. Uncle’s appropriately adjusted book value as of that date was $900,000.

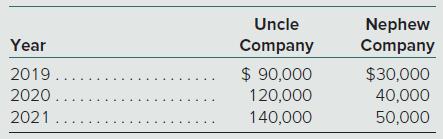

Separate operating income figures (not including investment income) for these two companies follow. In addition, Uncle declares and pays $20,000 in dividends to shareholders each year and Nephew

a. Assume that Uncle applies the equity method to account for this investment in Nephew. What is the subsidiary’s income recognized by Uncle in 2021?

b. What is the net income attributable to the noncontrolling interest for 2021?

Step by Step Answer:

Advanced Accounting

ISBN: 9781260247824

14th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik