It is Monday, September 13, Year 10. You, CPA, work at Fife & Richardson LLP, a CPA

Question:

It is Monday, September 13, Year 10. You, CPA, work at Fife & Richardson LLP, a CPA firm. Ken Simpson, one of the partners, approaches you mid-morning regarding Brennan & Sons Limited (BSL), a private company client for which you performed the August 31, Year 9, year-end audit.

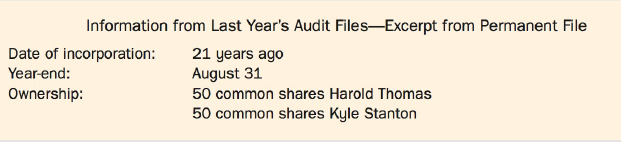

"It seems there have been substantial changes at BSL this year," Ken explains. "I'm going there tomorrow, and since you will be on the audit again this year, it would be beneficial for you to come. I took the liberty of retrieving information from last year's files so you can refresh your memory about this client" (see Exhibit I).

The next day, you and Ken meet with Jack Wright, the accounting manager at BSL. Jack gives you the internally prepared financial statements (Exhibit II). To your surprise, there are also financial statements for two new companies. Jack quickly explains that BSL incorporated two subsidiaries in January Year 10, each with the same year-end as BSL:

• Brennan Transport Ltd. (Transport)-100% owned by BSL

• Brennan Fuel Tank Installations Inc. (Tanks )--75% owned by BSL

You diligently take notes during the meeting (Exhibit Ill). Jack states that BSL will follow ASPE and will prepare consolidated financial statements to satisfy the bank's request.

Exhibit I:

Nature of the business: BSL operates as a scrap metal dealer and processor. It buys used scrap metal from individuals and businesses, then bundles the different metals and sells them in larger quantities at a higher price to bigger recycling businesses. BSL's revenue fluctuates significantly because of the volatility in the market rates for steel and non-ferrous metals. To help control costs, BSL uses its own trucks and trailers to do the pickups. BSL earns additional revenue by providing transportation services to other businesses and by renting out the trucks during slower periods.

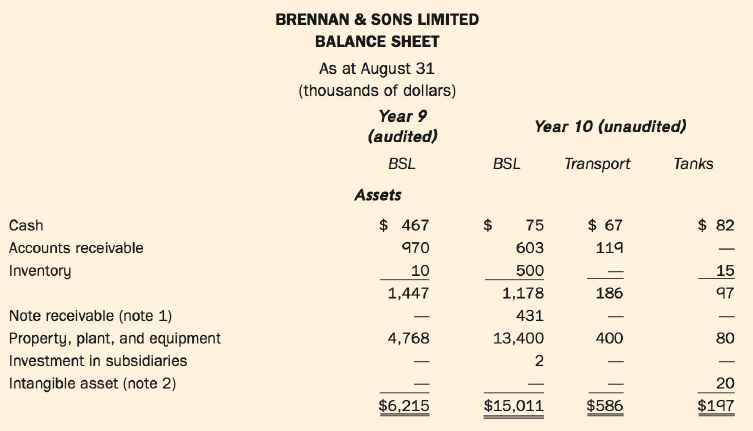

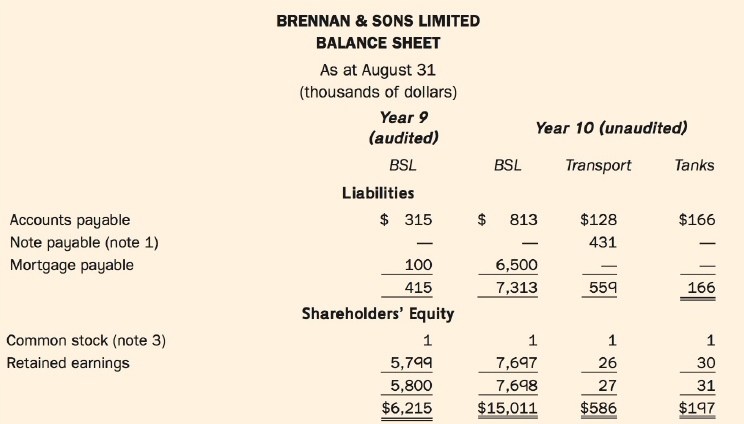

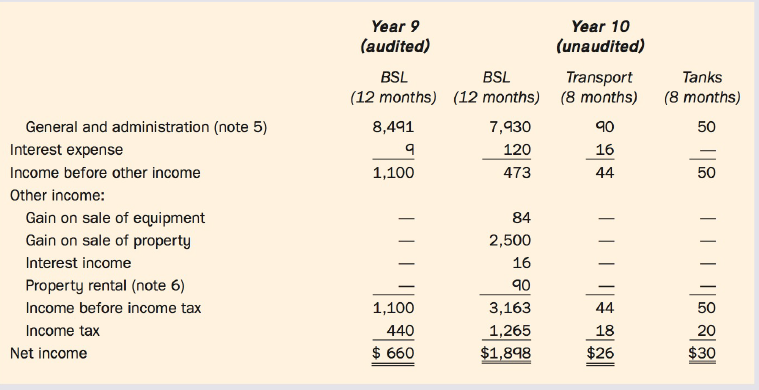

Exhibit II:

Internal Financial Statements

Notes:

1. Note receivable/payable for sale of trucks and trailers from BSL to Transport, interest at 8%.

2. Training costs for Sean Piper, owner/installer.

3. Includes Sean's equity interest.

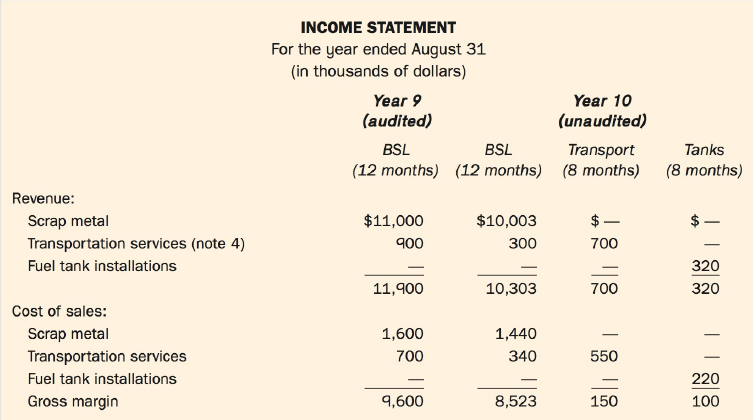

Notes:

4. Transport took over transportation services in January.

5. Year 10 General and administration includes amortization.

6. $10,000 per month from Transport and $5,000 per month from Tanks for six months.

Exhibit III:

Notes from Your Meeting with Jack Wright

BSL continues to operate the scrap metal business. BSL's management thinks the price of metal is going to go up in the near future, and has therefore started stockpiling for the first time. Unfortunately, BSL doesn't really have an inventory tracking system in place. If in fact it turns out stockpiling is a good way for BSL to make money, it will install a better system. The company did its best to log each of the amounts going into the stockpile as it was added, knowing that an amount for its year-end inventory balance would need to be determined. BSL also used a known engineering formula to come up with an estimate for year-end inventory and tried to measure the different piles of metal as a way of counting what was on hand at August 31, Year 10. The different methods came up with different amounts, so management went with the initial amount based on the log. Jack noted that we would have had a good laugh at the different ways they tried to measure the piles if we'd been there to see it.

As soon as it was incorporated on January 1, Year 10, Transport took over BSL's transportation operations. Transport provides transportation services to BSL and external customers, the same as BSL did. BSL sold the trucks to Transport in late January at fair market value; however, Transport didn't have the funds to buy the equipment, so BSL issued a note receivable at what Jack believed to be the market interest rate.

Tanks installs and maintains pre-engineered, above-ground fuel storage tank systems, a new line of business for BSL. Sean Piper, a good friend of one of BSL's owners, approached BSL last fall with the idea. Sean was willing to take the necessary training to become a certified fuel tank installer, and he wanted 50% ownership in Tanks. The owners of BSL agreed it was a great opportunity but wanted more control. The parties settled on Sean's receiving 25% ownership of Tanks.

As part of the agreement, BSL was req_uired to provide a guarantee pertaining to Tanks' licensing application to the environmental authority since Tanks was a newly formed corporation. Although other vendors sell the same tanks and installation services separately, Tanks only sells the tank combined with installation and service. The tank is marked up by 20% on the price paid and is sold including installation and a five-year maintenance package for a total of $40,000. One hundred percent of the revenue is recognized when the sales agreement is signed by the client. The tank is then delivered and installed at the client's site within two to three weeks of signing. The fuel tanks need to be pressure-tested every year and the measurement gauge needs to be checked. Tanks will perform the maintenance services for clients for the first five years. Thereafter, Tanks will offer to continue to perform the maintenance for a contract price of $5,000 a year.

BSL's owners decided it was time to move to a bigger location, so in March Year 10 the company sold its land and building on Frank St. and bought land and a building in the Johnson Industrial Park. The new building is large enough to accommodate all the companies' operations, and more. BSL's owners are thinking of renting some of the extra space to other businesses and have already been approached by a few interested parties. All tenants, including BSL's subsidiaries, will be charged the same rent per square foot, based on current market rates.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Dealer

A dealer in the securities market is an individual or firm who stands ready and willing to buy a security for its own account (at its bid price) or sell from its own account (at its ask price). A dealer seeks to profit from the spread between the...

Step by Step Answer:

Modern Advanced Accounting in Canada

ISBN: 978-1259087554

8th edition

Authors: Hilton Murray, Herauf Darrell