On January 1, 2023, French Company acquired 60 percent of K-Tech Company for $300,000 when K-Techs book

Question:

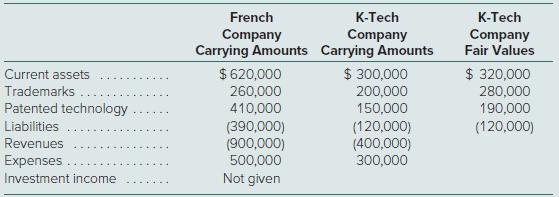

On January 1, 2023, French Company acquired 60 percent of K-Tech Company for $300,000 when K-Tech’s book value was $400,000. The fair value of the newly comprised 40 percent noncontrolling interest was assessed at $200,000. At the acquisition date, K-Tech’s trademark (10-year remaining life) was undervalued in its financial records by $60,000. Also, patented technology (5-year remaining life) was undervalued by $40,000.

In 2023, K-Tech reports $30,000 net income and declares no dividends. At the end of 2024, the two companies report the following figures (stockholders’ equity accounts have been omitted):

a. Compute the 2024 consolidated net income before allocation to the controlling and noncontrolling interests.b. In 2024, assuming K-Tech has declared no dividends, compute the noncontrolling interest’s share of the subsidiary’s income and the ending balance of the noncontrolling interest in the subsidiary.c. Compute the amount reported for trademarks in the 2024 consolidated balance sheet.

Step by Step Answer:

Fundamentals Of Advanced Accounting

ISBN: 9781266268533

9th International Edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik