On January 1, 2024, James Corporation exchanged $3,050,000 cash for 100 percent of the outstanding voting stock

Question:

On January 1, 2024, James Corporation exchanged $3,050,000 cash for 100 percent of the outstanding voting stock of Johnson Corporation. James plans to maintain Johnson as a wholly owned subsidiary with separate legal status and accounting information systems.

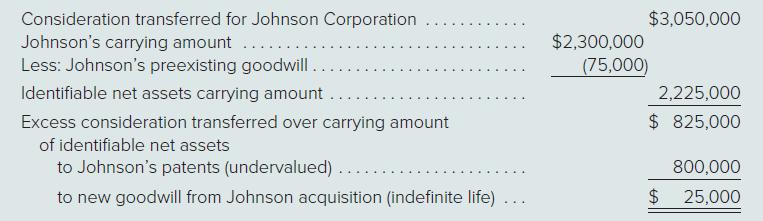

At the acquisition date, James prepared the following fair-value allocation schedule:

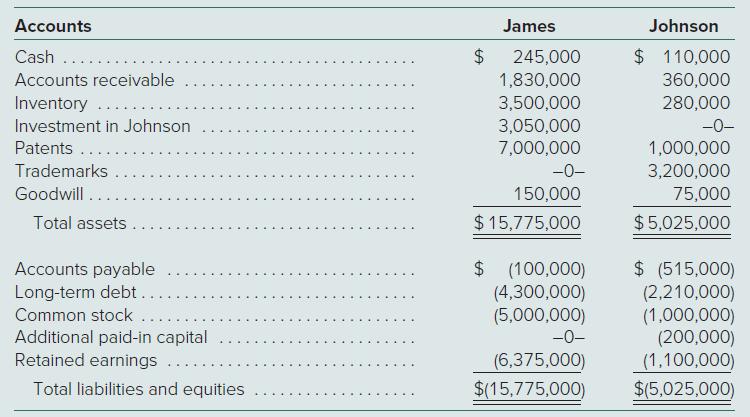

Immediately after closing the transaction, James and Johnson prepared the following postacquisition balance sheets from their separate financial records.

Prepare an acquisition-date consolidated balance sheet for James Corporation and its subsidiary Johnson Corporation.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Advanced Accounting

ISBN: 9781264798483

15th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer And Timothy Doupnik

Question Posted: