Parent Co. owns 75% of Sub Co. and uses the cost method to account for its investment.

Question:

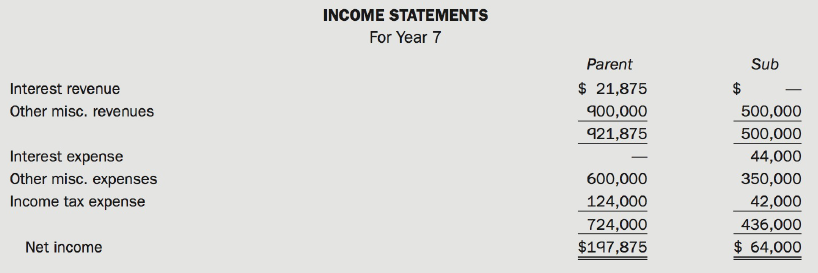

Parent Co. owns 75% of Sub Co. and uses the cost method to account for its investment. The following are summarized income statements for the year ended December 31, Year 7.

Additional Information:

• On July 1, Year 7, Parent purchased all of the outstanding bonds of Sub for $381,250. On that date, Sub had $400,000 of 10% bonds payable outstanding, which mature in five years. The bond discount on the books of Sub on July 1, Year 7, amounted to $20,000. Interest is payable January 1 and July 1. Any gains (losses) are to be allocated to each company. Both companies use the straight-line method to account for bonds.

• Sub Co. did not declare or pay dividends in Year 7.

Required

Prepare a consolidated income statement for Year 7 using a 40% tax rate.

Consolidated Income StatementWhen talking about the group financial statements the consolidated financial statements include Consolidated Income Statement that a parent must prepare among other sets of consolidated financial statements. Consolidated Income statement that is...

Step by Step Answer:

Modern Advanced Accounting in Canada

ISBN: 978-1259087554

8th edition

Authors: Hilton Murray, Herauf Darrell