Question: This problem is a continuation of the problem in Section 11.5 of the chapter. In the chapter, the workpaper was prepared for the year of

This problem is a continuation of the problem in Section 11.5 of the chapter. In the chapter, the workpaper was prepared for the year of the acquisition. In this problem, the consolidated statements are prepared for the second year after acquisition.

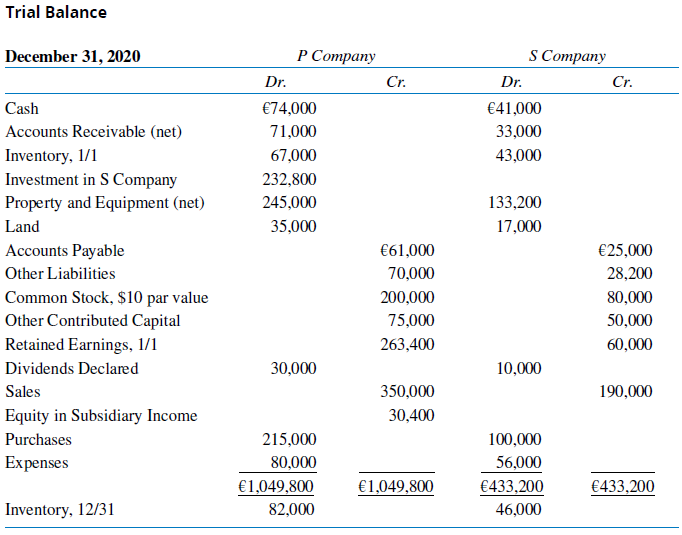

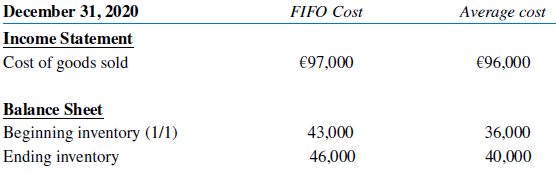

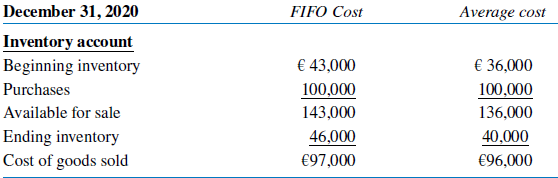

On January 1, 2019, P Company, a European based-company, purchased 80% of S Company for ?200,000 (when the common stock account was 80,000, other contributed capital was 50,000, and retained earnings were 40,000). The trial balances at the end of 2020 are reported below. P Company acquired S Company because it wanted to expand its operations geographically. S Company is located in the United States and will be classified as a CGU. P Company elects to test for impairment on December 31 of each year. Because both P Company and S Company sell similar inventory, their inventory policies must conform for consolidation purposes. P Company uses average cost for inventories and S Company used FIFO. In addition, P Company uses the proportionate method to record noncontrolling interest and the complete equity method to record the investment in S Company. There were no goodwill impairment charges during the year.

The following information was available for inventory for 2020. Consider the following inventory information (numbers in euros).

Required:

1. Prepare the computation and allocation of difference schedule for the date of acquisition.

2. Prepare the worksheet eliminating entries needed for consolidation for 2020.

3. Complete the consolidated workpaper for the year ended December 31, 2020.

4. Show the computation of noncontrolling interest in equity for 2020.

Trial Balance any Cr. December 31, 2020 S Company Dr. Dr. Cr. Cash 74,000 41,000 Accounts Receivable (net) 71,000 33,000 Inventory, 1/1 67,000 43,000 Investment in S Company Property and Equipment (net) 232,800 245,000 133,200 Land 35,000 17,000 Accounts Payable 61,000 25,000 Other Liabilities 70,000 28,200 200,000 Common Stock, $10 par value Other Contributed Capital Retained Earnings, 1/1 80,000 75,000 50,000 263,400 60,000 Dividends Declared 30,000 10,000 Sales 350,000 190,000 Equity in Subsidiary Income 30,400 Purchases 215,000 100,000 Expenses 80,000 56,000 1,049,800 1,049,800 433,200 433,200 Inventory, 12/31 82,000 46,000 December 31, 2020 Income Statement Cost of goods sold FIFO Cost Average cost 96,000 97,000 Balance Sheet Beginning inventory (1/1) Ending inventory 43,000 46,000 36,000 40,000

Step by Step Solution

3.38 Rating (173 Votes )

There are 3 Steps involved in it

Part 1 Parent Share Noncontrolling Share Total Value Purchase price and implied value 200000 50000 250000 Less Book value of equity acquired Common stock 64000 16000 80000 Other contributed capital 40... View full answer

Get step-by-step solutions from verified subject matter experts