Right Company purchased 25,000 common shares (25%) of ON Inc. on January 1, Year 11, for $250,000.

Question:

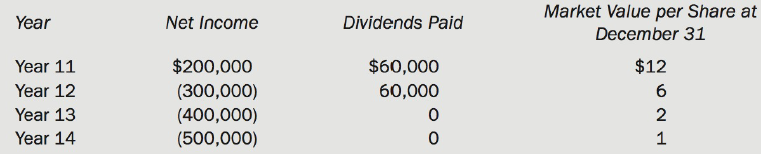

Right Company purchased 25,000 common shares (25%) of ON Inc. on January 1, Year 11, for $250,000. Right uses the equity method to report its investment in ON because it has significant influence in the operating and investing decisions made by ON. Right has no legal obligation to pay any of ON's liabilities and has not committed to contribute any more funds to ON. Additional information for ON for the four years ending December 31, Year 14, is as follows:

(a) Calculate the balance in the investment account for each of the Years 11 through 14. Assume that the market value is used in determining whether the investment is impaired.

(b) Determine the total income to be reported by Right from its investment in ON for each of the Years 11 through 14.

Step by Step Answer:

Modern Advanced Accounting in Canada

ISBN: 978-1259087554

8th edition

Authors: Hilton Murray, Herauf Darrell