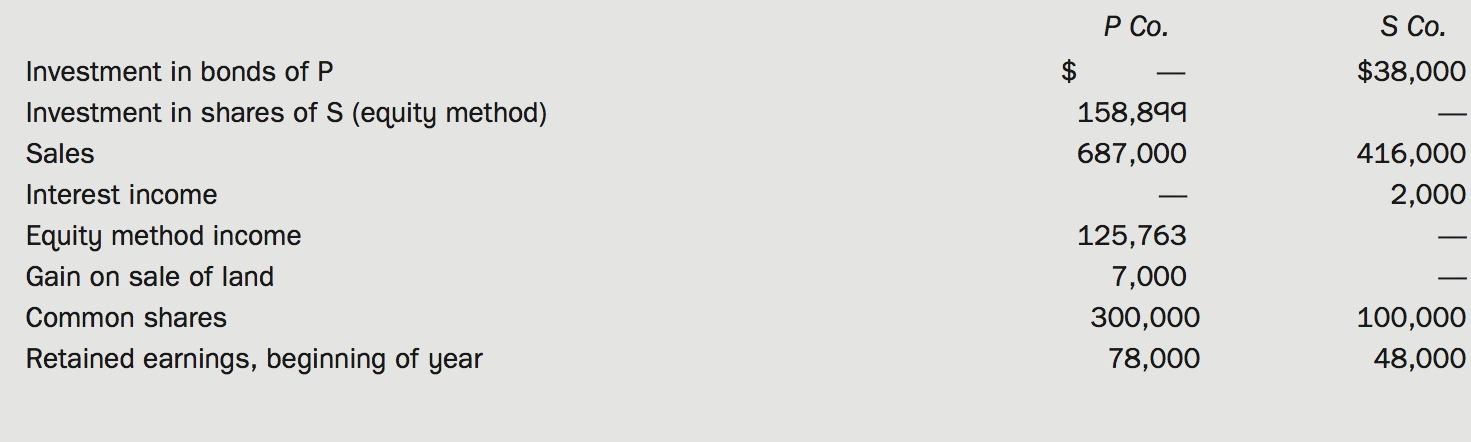

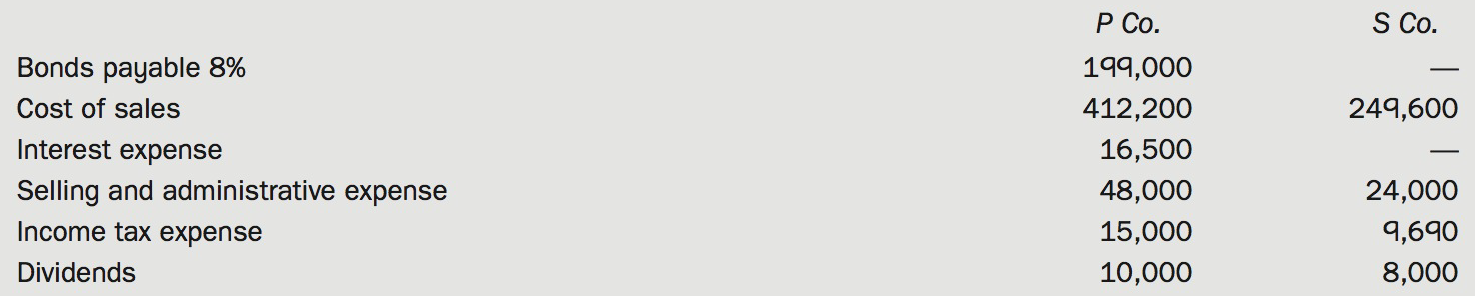

Shown below are selected ledger accounts from the trial balance of a parent and its subsidiary as

Question:

Shown below are selected ledger accounts from the trial balance of a parent and its subsidiary as of December 31, Year 10.

Additional Information:

• P Company purchased its 90% interest in S Company in Year 2, on the date that S Company was incorporated, and has followed the eq_uity method to account for its investment since that date.

• On April 1, Year 6, land that had originally cost $21,000 was sold by S Company to P Company for $28,000. P purchased the land with the intention of developing it, but in Year 10 it decided that the location was not suitable and the land was sold to a chain of drug stores.

• On January 1, Year 3, P Company issued $200,000 face value bonds due in 10 years. The proceeds from the bond issue amounted to $195,000.

• On July 1, Year 10, S Company purchased $40,000 of these bonds on the open market at a cost of $38,000. Intercompany bondholding gains (losses) are allocated between the two affiliates.

• S Company had $76,000 in sales toP Company during Year 10.

• Use income tax allocation at a 40% tax rate.

Required:

(a) Prepare a consolidated income statement for Year 10.

(b) Prepare a consolidated statement of retained earnings for Year 10.

Consolidated Income StatementWhen talking about the group financial statements the consolidated financial statements include Consolidated Income Statement that a parent must prepare among other sets of consolidated financial statements. Consolidated Income statement that is... Face Value

Face value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. For stocks, the face value is the original cost of the stock, as listed on the certificate. For bonds, it is the amount paid to the...

Step by Step Answer:

Modern Advanced Accounting in Canada

ISBN: 978-1259087554

8th edition

Authors: Hilton Murray, Herauf Darrell