Surat Limited paid cash to acquire an aircraft on January 1, 2020, at a cost of 30,000,000

Question:

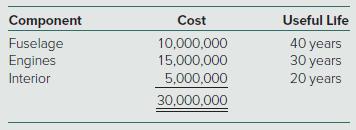

Surat Limited paid cash to acquire an aircraft on January 1, 2020, at a cost of 30,000,000 rupees. The aircraft has an estimated useful life of 40 years and no salvage value. The company has determined that the aircraft is composed of three significant components with the following original costs (in rupees) and estimated useful lives:

The U.S. parent of Surat does not depreciate assets on a component basis, but instead depreciates assets over their estimated useful life as a whole.

a. Determine the appropriate accounting for this aircraft for the years ending December 31, 2020, and December 31, 2021, under (1) IFRS and (2) U.S. GAAP.

b. Prepare the entry(ies) that the U.S. parent would make on the December 31, 2020, and December 31, 2021, conversion worksheets to convert IFRS balances to U.S. GAAP.

Assume that a foreign company using IFRS is owned by a company using U.S. GAAP. Thus, IFRS balances must be converted to U.S. GAAP to prepare consolidated financial statements.

Step by Step Answer:

Advanced Accounting

ISBN: 9781260247824

14th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik