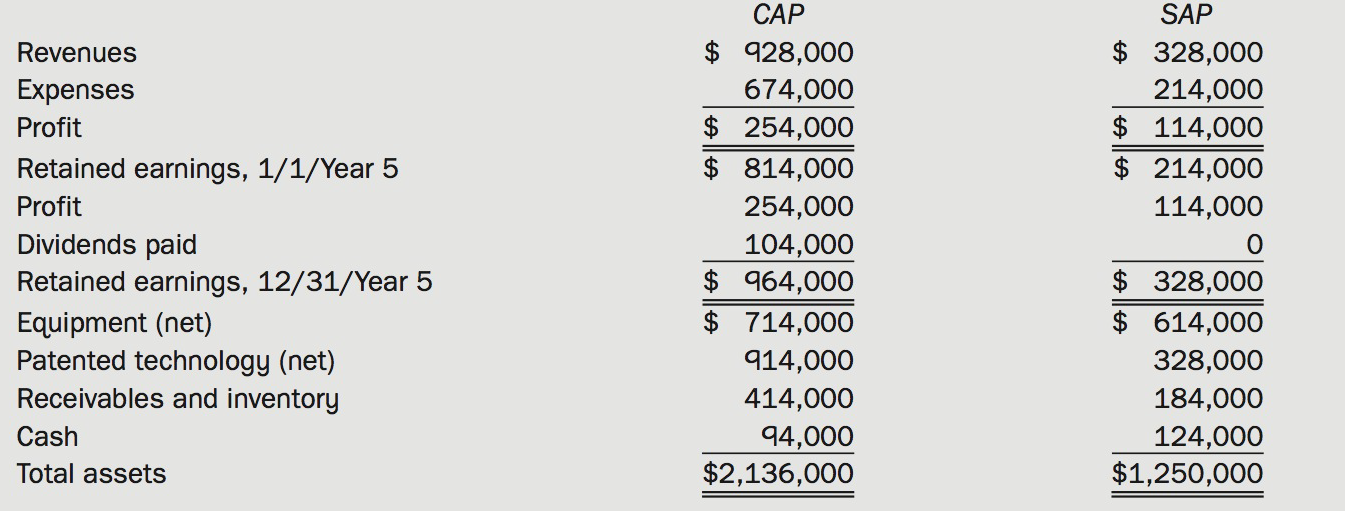

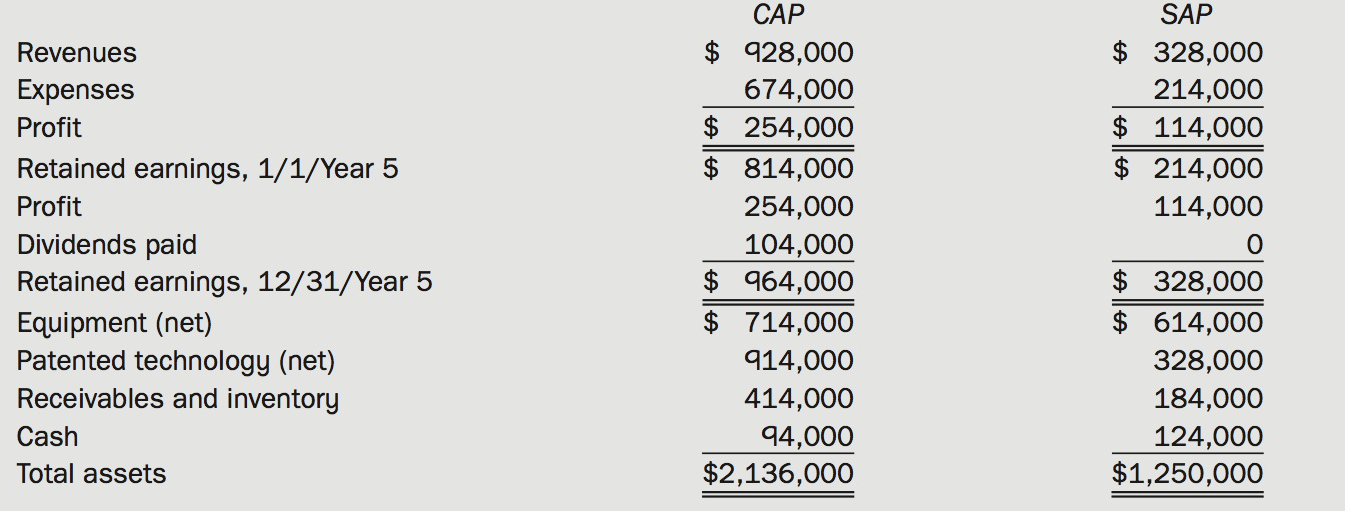

The financial statements for CAP Inc. and SAP Company for the year ended December 31, Year 5,

Question:

The financial statements for CAP Inc. and SAP Company for the year ended December 31, Year 5, follow:

On December 31, Year 5, after the above figures were prepared, CAP issued $314,000 in debt and 12,400 new shares to the owners of SAP to purchase all of the outstanding shares of that company. CAP shares had a fair value of $54 per share.

CAP also paid $37,000 to a broker for arranging the transaction. In addition, CAP paid $54,000 in stock issuance costs. SAP's equipment was actually worth $752,000 but its patented technology was valued at only $248,000.

What are the balances for the following accounts on the Year 5 consolidated financial statements?

(a) Profit

(b) Retained earnings, 12/31/Year 5

(c) Equipment

(d) Patented technology

(e) Goodwill

(f) Ordinary shares

(g) Liabilities

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Broker

A broker is someone or something that acts as an intermediary third party, managing transactions between two other entities. A broker is a person or company authorized to buy and sell stocks or other investments. They are the ones responsible for...

Step by Step Answer:

Modern Advanced Accounting in Canada

ISBN: 978-1259087554

8th edition

Authors: Hilton Murray, Herauf Darrell