What amount of foreign exchange gain or loss should be reflected in McCarthys 2020 consolidated net income?

Question:

What amount of foreign exchange gain or loss should be reflected in McCarthy’s 2020 consolidated net income?

a. $8,000 loss.

b. $10,000 loss.

c. $2,000 gain.

d. $5,000 gain.

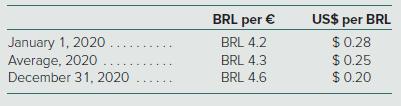

McCarthy, Inc.’s Brazilian subsidiary borrowed 100,000 euros on January 1, 2020. Exchange rates between the Brazilian real (BRL) and euro (€) and between the U.S. dollar ($) and BRL are as follows:

Transcribed Image Text:

BRL per € US$ per BRL January 1, 2020 Average, 2020 .... December 31, 2020 BRL 4.2 $0.28 BRL 4.3 $0.25 BRL 4.6 $0.20 ...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 78% (14 reviews)

b On December 31 2020 the Brazilian subsidiary would recognize a ...View the full answer

Answered By

JAPHETH KOGEI

Hi there. I'm here to assist you to score the highest marks on your assignments and homework. My areas of specialisation are:

Auditing, Financial Accounting, Macroeconomics, Monetary-economics, Business-administration, Advanced-accounting, Corporate Finance, Professional-accounting-ethics, Corporate governance, Financial-risk-analysis, Financial-budgeting, Corporate-social-responsibility, Statistics, Business management, logic, Critical thinking,

So, I look forward to helping you solve your academic problem.

I enjoy teaching and tutoring university and high school students. During my free time, I also read books on motivation, leadership, comedy, emotional intelligence, critical thinking, nature, human nature, innovation, persuasion, performance, negotiations, goals, power, time management, wealth, debates, sales, and finance. Additionally, I am a panellist on an FM radio program on Sunday mornings where we discuss current affairs.

I travel three times a year either to the USA, Europe and around Africa.

As a university student in the USA, I enjoyed interacting with people from different cultures and ethnic groups. Together with friends, we travelled widely in the USA and in Europe (UK, France, Denmark, Germany, Turkey, etc).

So, I look forward to tutoring you. I believe that it will be exciting to meet them.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Advanced Accounting

ISBN: 9781260247824

14th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik

Question Posted:

Students also viewed these Business questions

-

Explain what causes an exchange gain or loss and when each occurs.

-

Show how the following events should be reflected in the accounts at 31 December 2015 and describe audit procedures you would carry out to verify them: Company B acquired non-current assets for...

-

Question 1. This question is based on a journal article that appeared in the New England Journal of Medicine: Gawande AA et al., "Risk factors for retained instruments and sponges after surgery."...

-

Someone offered the investment options to Hendry on January 1, 2023: 1. Hendry has to save up to 5 times the initial deposit of US $ 150,000/year. 2. The savings cannot be taken for 20 years until...

-

(a) What is the specific heat of liquid water? (b) What is the molar heat capacity of liquid water? (c) What is the heat capacity of 185 g of liquid water? (d) How many kJ of heat are needed to raise...

-

Kruger Industrial Smoothing has the following: $100,000 face value 5% bonds paid semiannually that currently trade at 1.05 with 6 years to maturity 1,000 preferred shares with a $25 par value, a...

-

Compare and contrast prototyping and the incremental and iterative approach to software development.

-

Use regression analysis on deseasonalized demand to forecast demand in summer 2013, given the following historical demanddata: YEAR SEASON ACTUAL DEMAND 2011 Spring 205 Summer Winter Summer Winter...

-

A company has total fixed costs of $252000 and a contribution margin ratio of 25%. What is the total sales necessary to break even?

-

The records of Andrews Company reflect the following data: Work in process, beginning of the month - 4,500 units; 1 / 3 completed at a cost of $2,400 for materials, $825 for labor, and $5,000 for...

-

At what amount should the Brazilian subsidiarys euro note payable be reported on McCarthys December 31, 2020, consolidated balance sheet? a. $84,000. b. $86,000. c. $92,000. d. $128,800. McCarthy,...

-

The following accounts are denominated in rubles as of December 31, 2020. For reporting purposes, these accounts need to be stated in U.S. dollars. For each account, indicate the exchange rate that...

-

The following events apply to The Ice Cream Parlor for the 2013 fiscal year: 1. The company started when it acquired $20,000 cash from the issue of common stock. 2. Purchased a new ice cream machine...

-

Watson Heater Company sells portable heaters and related equipment. The business uses a perpetual inventory system, and the cost of its inventory at the beginning of November was \(\$ 2600\). Its...

-

Many long-term loans are payable over a period of time. For example, when a business takes out a mortgage to finance a building, it pays off a fraction of that mortgage every month. Required: What...

-

While reviewing the Taber Business' income statement for the year, you find that it had sales of \(\$ 81500\), cost of goods sold of \(\$ 50000\) and wages expense of \(\$ 30200\). A review of its...

-

ABC Optical began 20X1 with accounts receivable of \(\$ 44800\) and inventory of \(\$ 56000\). During \(20 \mathrm{X} 1\) the business made total net sales of \(\$ 840000\), of which 70 per cent were...

-

Among other items, the Andy's Business' income statement for the year shows sales revenue of \(\$ 156000\), cost of goods sold of \(\$ 92600\) and salaries expense of \(\$ 24400\). An analysis of its...

-

Identify the similarities and differences between a trial balance and an adjusted trial balance. What is the purpose of each one?

-

An annual report of The Campbell Soup Company reported on its income statement $2.4 million as equity in earnings of affiliates. Journalize the entry that Campbell would have made to record this...

-

Define or explain the terms parent company, subsidiary company, affiliates, and associates.

-

Define or explain the terms parent company, subsidiary company, affiliates, and associates.

-

What is a noncontrolling interest?

-

Suppose that (an) satisfies an #0 Vn N and lim =r <1. an Prove that Clan converges and in particular an converges. (a) Show that there exists kEN such that for all nk we have lan+1 Sans where s= (b)...

-

The Fellsway Bank is considering placing ATM machines in the town centers of some of the following six communities: Arlington, Belmont, Cambridge, Winchester, Stoneham, and Melrose. The bank would...

-

Stephens, Inc currently pays a $3 per share dividend, but is considering eliminating the dividend and using the savings to repurchase shares. Investments of similar risk to Stephens provide an...

Study smarter with the SolutionInn App