Someone offered the investment options to Hendry on January 1, 2023: 1. Hendry has to save...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

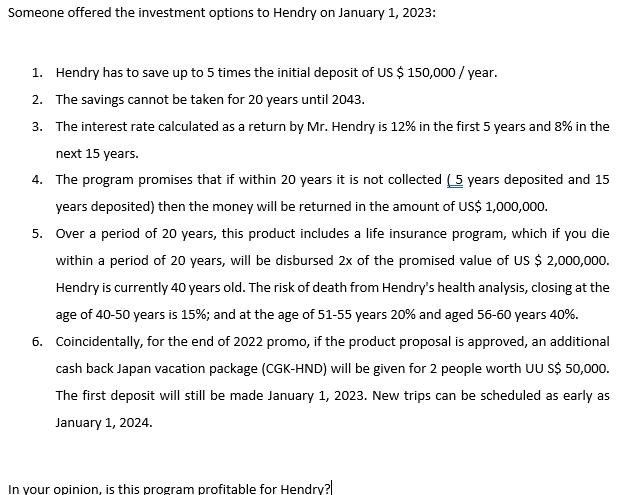

Someone offered the investment options to Hendry on January 1, 2023: 1. Hendry has to save up to 5 times the initial deposit of US $ 150,000/year. 2. The savings cannot be taken for 20 years until 2043. 3. The interest rate calculated as a return by Mr. Hendry is 12% in the first 5 years and 8% in the next 15 years. 4. The program promises that if within 20 years it is not collected (5 years deposited and 15 years deposited) then the money will be returned in the amount of US$ 1,000,000. 5. Over a period of 20 years, this product includes a life insurance program, which if you die within a period of 20 years, will be disbursed 2x of the promised value of US $ 2,000,000. Hendry is currently 40 years old. The risk of death from Hendry's health analysis, closing at the age of 40-50 years is 15%; and at the age of 51-55 years 20% and aged 56-60 years 40%. 6. Coincidentally, for the end of 2022 promo, if the product proposal is approved, an additional cash back Japan vacation package (CGK-HND) will be given for 2 people worth UU S$ 50,000. The first deposit will still be made January 1, 2023. New trips can be scheduled as early as January 1, 2024. In your opinion, is this program profitable for Hendry? Someone offered the investment options to Hendry on January 1, 2023: 1. Hendry has to save up to 5 times the initial deposit of US $ 150,000/year. 2. The savings cannot be taken for 20 years until 2043. 3. The interest rate calculated as a return by Mr. Hendry is 12% in the first 5 years and 8% in the next 15 years. 4. The program promises that if within 20 years it is not collected (5 years deposited and 15 years deposited) then the money will be returned in the amount of US$ 1,000,000. 5. Over a period of 20 years, this product includes a life insurance program, which if you die within a period of 20 years, will be disbursed 2x of the promised value of US $ 2,000,000. Hendry is currently 40 years old. The risk of death from Hendry's health analysis, closing at the age of 40-50 years is 15%; and at the age of 51-55 years 20% and aged 56-60 years 40%. 6. Coincidentally, for the end of 2022 promo, if the product proposal is approved, an additional cash back Japan vacation package (CGK-HND) will be given for 2 people worth UU S$ 50,000. The first deposit will still be made January 1, 2023. New trips can be scheduled as early as January 1, 2024. In your opinion, is this program profitable for Hendry?

Expert Answer:

Answer rating: 100% (QA)

Long term assets Life insurance companies invest mainly their pooled funds in long term assets tha... View the full answer

Related Book For

Income Tax Fundamentals 2013

ISBN: 9781285586618

31st Edition

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

Posted Date:

Students also viewed these economics questions

-

A sample of 50 funds deposited in First Federal Savings Banks MCA (miniature checking account) revealed the following amounts. Use a statistical software package such as Excel or Minitab to help...

-

Die A is rolled 50 times and a 6 is scored 4 times, while a 6 is obtained 10 times when die B is rolled 50 times. (a) Construct a two-sided 99% confidence interval for the difference in the...

-

Period Average annual rate of inflation 3 months 5 2 years 6 5 years 8 10 years 85 20 years 9 a If the real rate of interest is currently 25 find the nominal rate of interest on each of the following...

-

Two tiny particles having charges of 5.76 C and -7 C are placed along the y-axis. The 5.76 C particle is at y = 0 cm, and the other particle is at y = 48.74 cm. Where must a third charged particle be...

-

Monette Health Center provides a variety of medical services. The company is preparing its cash budget for the upcoming third quarter. The following transactions are expected to occur: a. Cash...

-

For a company that uses a year as its interest period, determine the net cash flow that will be recorded at the end of the year from the cash flowsshown. Receipts, Disbursements, Month an Feb Mar Apr...

-

Johanna Marra and Eric Nazzaro began a romantic relationship in October 2013. That previous July, Nazzarro had purchased a duplex that he intended to renovate. Nazzarro rented out the top floor while...

-

Harding Corporation has the following accounts included in its December 31, 2012, trial balance: Accounts Receivable $110,000; Inventory $290,000; Allowance for Doubtful Accounts $8,000; Patents...

-

3) Lets revisit the 2-D shallow water equations, but this time assume no rotation (f= 0) but the wave is embedded in a mean zonal flow U: V= (U+u'(x, 1)) + v'(x, 1); (1) where variables in bold are...

-

A mixture of three amino aids is separated by gel electrophoresis. The three amino acids are glycine, valine and phenylalanine (Figure 27.14). a. The electrophoresis is carried out in a buffer...

-

1)The concept of commercial substance in purchase and sales transactions means that the entity's cash flows are expected to change. the transaction is a bona fide purchase and sale, and the entity's...

-

9/2/1 You learned in previous courses that the slope of a non-vertical straight line is or Ar 22 21 where (1.1) and (22, y2) are any two points on the line. Most functions we see in calculus have the...

-

A tailor must make 7 of the same size suits for a client. The first suit took 13 hours to make and the last suit took 6.2 hours to make. What was the tailor's learning curve % of this run of suits...

-

Lola purchased a personal vacation home (cottage) through her corporation. She uses the cottage to enjoy her vacations with friends and family. The corporation funded the purchase and pays for all...

-

Why must managers know the specific revenues and expenses related to each food and beverage outlet? How does a labor shortage affect operations and discuss strategies which can be implemented to...

-

1)What was FireEye's AI strategy i.e., how did management decide whether or not to move forward on an AI initiative? 2)Comment on how the Atomicity (deep-learning neural network) was developed using...

-

Paul Pogba, who plays football for Manchester United in the English Premier League, has been offered two football boot endorsements as per below. Option 1 - a single payment of US$15 million now by...

-

The Alert Company is a closely held investment-services group that has been very successful over the past five years, consistently providing most members of the top management group with 50% bonuses....

-

John Williams (age 42) is a single taxpayer, and he lives at 1324 Forest Dr., Reno, NV 89501. His Social Security number is 555-94-9358. John's earnings and withholdings as the manager of a local...

-

In 2012, Lou has a salary of $54,000 from her job. She also has interest income of $1,700. Lou is single and has no dependents. During the year, Lou sold silver coins held as an investment for a...

-

Cypress Corporation has regular taxable income of $170,000 (assume annual gross receipts are greater than $5 million) and regular tax liability of $49,550 for 2012. The corporation also has tax...

-

Economy Appliance Co. manufactures lowprice, no-frills appliances that are in great demand for rental units. Pricing and cost information on Economys main products are as shown on page 943. Customers...

-

Grill Master Company sells total outdoor grilling solutions, providing gas and charcoal grills, accessories, and installation services for custom patio grilling stations. Instructions Respond to the...

-

Tablet Tailors sells tablet PCs combined with Internet service (Tablet Bundle A) that permits the tablet to connect to the Internet anywhere (set up a Wi-Fi hot spot). The price for the tablet and a...

Study smarter with the SolutionInn App