Question: White Company was incorporated on January 2, Year 1, and commenced active operations immediately. Common shares were issued on the date of incorporation and no

White Company was incorporated on January 2, Year 1, and commenced active operations immediately.

Common shares were issued on the date of incorporation and no new common shares have been issued since then. On December 31, Year 5, Black Company purchased 70% of the outstanding common shares of White for 1.33 million foreign pesos (FP). On this date, the fair values of White's identifiable net assets were equal to their carrying amounts except for a building, which had a fair value of FP99,000 in excess of carrying amount. The remaining useful life of the building was 10 years at the date of acquisition.

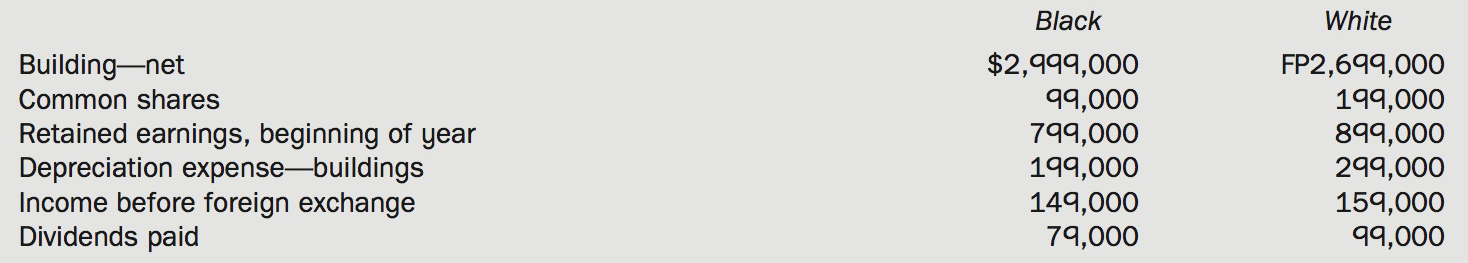

The following information was extracted from the financial records of the two companies for the year ended December 31, Year 6:

Additional Information:

• Black uses the cost method to account for its investment in White.

• White purchased its building on December 31, Year 3.

• The recoverable amount for goodwill at the end of Year 6 was FP719,000.

• Dividends were declared and paid on July 1.

• Foreign exchange rates were as follows:

Jan. 2, Year 1 FP1 = $0.30

Dec. 31, Year 3 FP1 = $0.24

Dec. 31, Year 5 FP1 = $0.20

Average for Year 6 FP1 = $0.18

July 1, Year 6 FP1 = $0.17

Dec. 31, Year 6 FP1 = $0.15

Required

(a) Compute the balances that would appear in the Year 6 consolidated financial statements for the following items, assuming that White's functional currency is the Canadian dollar. White's income before foreign exchange gains is $29,000, and the exchange gains from translating White's separate-entity financial statements to Canadian dollars are $49,000.

(i) Building-net

(ii) Goodwill

(iii) Depreciation expense-building

(iv) Net income (excluding other comprehensive income)

(v) Other comprehensive income

(vi) Non-controlling interest on the income statement

(vii) Non-controlling interest on the balance sheet

(b) Compute the balances that would appear in the Year 6 consolidated financial statements for the same accounts as in part (a), assuming that White's functional currency is the foreign peso.

White Black $2,999,000 99,000 799,000 Building-net FP2,699,000 199,000 899,000 299,000 159,000 99,000 Common shares Retained earnings, beginning of year Depreciation expense-buildings Income before foreign exchange Dividends paid 199,000 149,000 79,000

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Calculation allocation and amortization of acquisition differential a i Building net Canadian Blacks building 2999000 Whites building FP2699000 020 539800 Unamortized acquisition differential FP89100 ... View full answer

Get step-by-step solutions from verified subject matter experts