Consider a set of (N) risky assets and, for parts (a)-(c), no riskless asset. (a) Prove that

Question:

Consider a set of \(N\) risky assets and, for parts (a)-(c), no riskless asset.

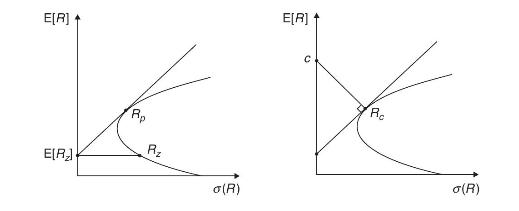

(a) Prove that for any minimum-variance portfolio \(p\), except the global minimumvariance portfolio, the expected return on a minimum-variance portfolio \(z\) that is uncorrelated with \(p\) can be found as follows. On a mean-standard deviation diagram, draw a tangency line to the minimum-variance frontier at the point \(p\). The point where this tangency line reaches the vertical axis of the diagram gives the expected return on the zero-beta portfolio \(z\). (This expected return is known as the zero-beta rate for portfolio \(p\).) This construction is illustrated in the left panel of Figure 2.6.

(b) Prove that every portfolio has the same covariance with the global minimumvariance portfolio. Give the economic intuition for this result. Explain why this is consistent with the exclusion of the global minimum-variance portfolio in part (a).

Figure 2.6

(c) Consider a linear regression of a constant \(c \in \mathbb{R}\) on the \(N\) risky returns that is restricted so that the regression coefficients sum to one: \({ }^{10}\)

Equation 2.67

![]()

Show that \(w_{c}\) corresponds to the weights of the minimum-variance portfolio \(R^{c}\) depicted in the right panel of Figure 2.6. That is, \(R^{c}\) is the portfolio whose depiction in a mean-standard deviation graph is closest to point \((0, c)\). It follows that as one varies the constant \(c\) in equation (2.67) the regression weights trace out the portfolios in the minimum-variance frontier. Interpret this result intuitively.

(d) Now suppose that there exists a riskfree asset in addition to the \(N\) risky assets. Argue graphically that the weights of the tangency portfolio can be obtained as \(w_{c} / l^{\prime} w_{c}\), where \(w_{c}\) is the vector of coefficients in an (unrestricted) linear regression of an arbitrary nonzero constant \(c\) on the \(N\) excess risky asset returns, \(c=\left(R-R_{f} light)^{\prime} w_{c}+\varepsilon\).

Step by Step Answer:

Financial Decisions And Markets A Course In Asset Pricing

ISBN: 9780691160801

1st Edition

Authors: John Y. Campbell