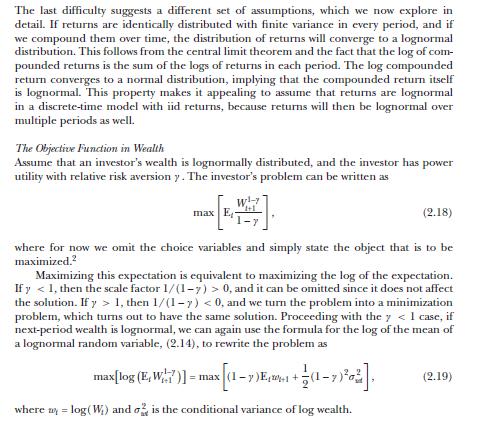

Consider an investor who chooses a portfolio to maximize his expected utility of wealth next period, where

Question:

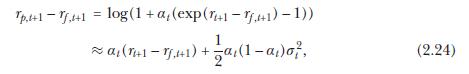

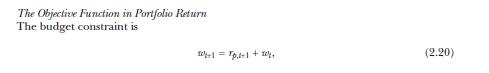

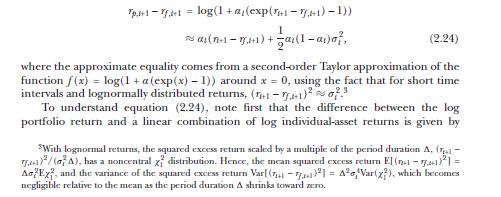

Consider an investor who chooses a portfolio to maximize his expected utility of wealth next period, where the utility function is power (CRRA) with coefficient of relative risk aversion \(\gamma\). Assume that there are two assets, a riskless asset with \(\log\) return \(r_{f}\) and a risky asset with \(\log\) return \(r\). Assume that the \(\log\) risky return is normal with variance \(\sigma^{2}\) and that the optimal portfolio places a weight \(\alpha\) on the risky asset. Use the approximation to the \(\log\) portfolio return (2.24) to analyze this model. Also use the formulation of the Sharpe ratio in terms of moments of log returns, as discussed in section 2.1.4. That is, write the Sharpe ratio as \(S=\left(\mathrm{E}[r]-r_{f}+\sigma^{2} / 2ight) / \sigma\).

Equation 2.24

(a) Derive an expression for the value function (the investor's maximized utility) as a function of initial wealth, the riskless interest rate, the coefficient of relative risk aversion, and the Sharpe ratio of the risky asset.

(b) Suppose that the time period is one year. The log riskless interest rate is \(2 \%\), the \(\log\) of the expected simple return on the risky asset is \(10 \%\), and the standard deviation of the log risky asset return is \(40 \%\). The investor initially chooses to hold \(25 \%\) of his portfolio in the risky asset. What must his risk aversion be?

(c) Now suppose that the standard deviation of the log risky asset return declines to \(20 \%\), but the riskless interest rate and the expected simple return on the risky asset do not change. (This could result from improved diversification of underlying idiosyncratic risky opportunities that are packaged into a single fund that is marketed to the investor.) If the investor's portfolio weight in the risky asset does not change, show that the effect on the value function is equivalent to an increase in the riskless interest rate of \(a\) percentage points. What is \(a\) ? If the investor adjusts his portfolio weight in the risky asset to its new optimal level, show that the effect on the value function is equivalent to an increase in the riskless interest rate of \(b\) percentage points. What is \(b\) ? Is \(b\) larger or smaller than \(a\) ? Explain.

(d) When risky assets become safer (because of improved diversification or for other reasons), do conservative (relatively risk-averse) or aggressive (relatively risktolerant) investors gain the most? How does your answer depend on the ability of investors to adjust their holdings of risky assets? Explain.

Data from section 2.1.4

Step by Step Answer:

Financial Decisions And Markets A Course In Asset Pricing

ISBN: 9780691160801

1st Edition

Authors: John Y. Campbell