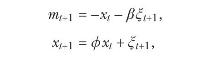

Consider the following model for the log stochastic discount factor, (m_{t+1}) : where (xi_{t+1}) is randomly drawn

Question:

Consider the following model for the log stochastic discount factor, \(m_{t+1}\) :

where \(\xi_{t+1}\) is randomly drawn from one of two distributions. With probability \(\pi\), state 1 occurs at time \(t+1\) and \(\xi_{t+1}=\xi_{1, t+1}\), where \(\xi_{1, t+1} \sim \mathcal{N}\left(0, \sigma_{1}^{2}ight)\); with probability \(1-\pi\), state 2 occurs at time \(t+1\) and \(\xi_{t+1}=\xi_{2, t+1}\), where \(\xi_{2, t+1} \sim \mathcal{N}\left(0, \sigma_{2}^{2}ight)\).

(a) Is the stochastic discount factor \(M_{t+1}\) lognormally distributed, conditional on information available at time \(t\) ? Is it lognormally distributed, conditional on information available at time \(t\) and knowledge of the state ( 1 or 2 ) that occurs at time \(t+1\) ?

(b) Solve for the one-period zero-coupon bond yield, 1+ \(Y_{1 t}\), in this economy. Show that the log short yield, \(y_{1 t} \equiv \log \left(1+Y_{1 t}ight)\), is linear in the state variable \(x_{t}\).

(c) Use the recursive pricing equation for bonds (8.29) to show that all log bond yields are linear in \(x_{t}\). Derive an expression for the slope coefficient \(B_{n}\) relating the log \(n\)-period bond price to the state variable \(x_{t}\), as in (8.36). What is the standard name for models with log bond yields linear in state variables? What makes this model different from other models you have seen with this property?

Equation 8.29

Equation 8.36

(d) Which of the following phenomena are displayed by this model? Explain.

(i) Time-varying risk premia in the term structure of interest rates.

(ii) Changing volatility of interest rates.

(iii) Excess kurtosis of interest rate movements.

(iv) Imperfect conditional correlation of returns on bonds with different maturities.

Step by Step Answer:

Financial Decisions And Markets A Course In Asset Pricing

ISBN: 9780691160801

1st Edition

Authors: John Y. Campbell