Christoph Hoffeman trades currency for RiverRock Capital of Geneva. Christoph has USD10 million to begin with, and

Question:

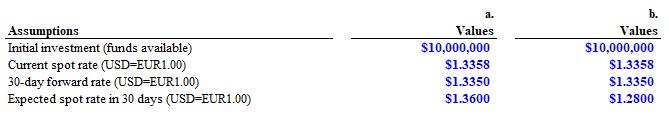

Christoph Hoffeman trades currency for RiverRock Capital of Geneva. Christoph has USD10 million to begin with, and he must state all profits at the end of any speculation while the 30-day forward rate is USD1.3350 = EUR1.00.

a. If Christoph believes the euro will continue to rise in value against the U.S. dollar and expects the spot rate to be USD1.3600 = EUR1.00 at the end of 30 days, what should he do?

b. If Christoph believes the euro will depreciate in value against the U.S. dollar and expects the spot rate to be USD1.2800 = EUR1.00 at the end of 30 days, what should he do?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Multinational Business Finance

ISBN: 9780137496013

16th Edition

Authors: David K. Eiteman, Arthur I. Stonehill, Michael H. Moffett

Question Posted: