Question: The WorldValue fund has value weights on asset classes and returns as given in the table below. There are four major asset classes: Europe,

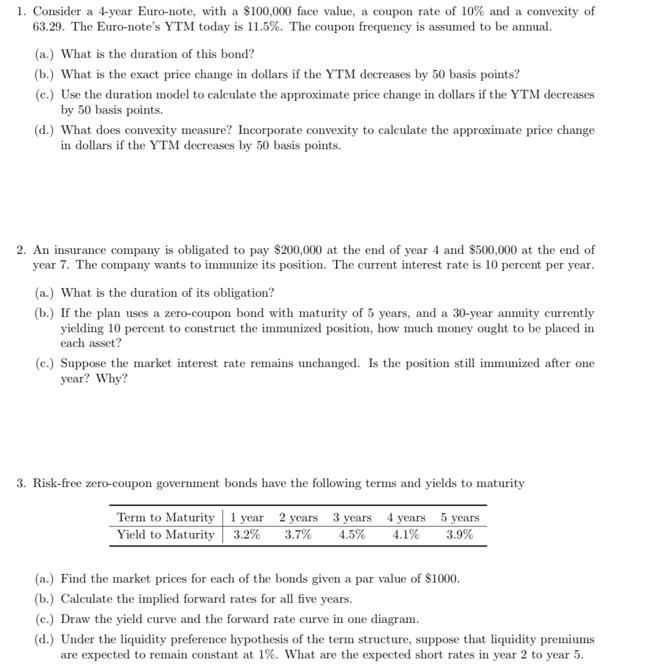

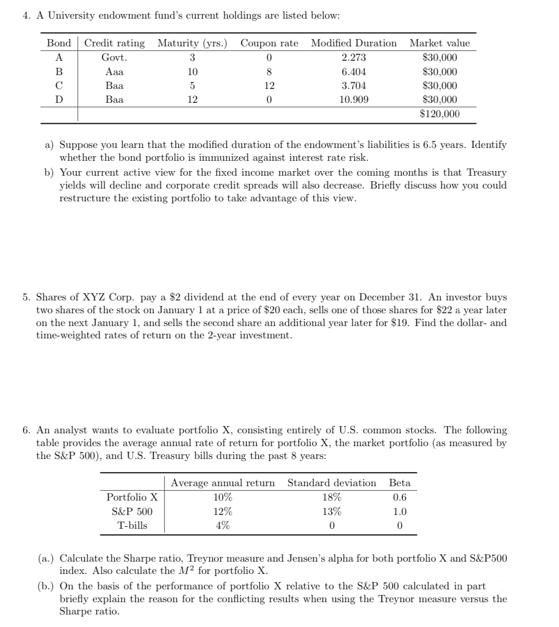

The WorldValue fund has value weights on asset classes and returns as given in the table below. There are four major asset classes: Europe, Pacific, Emerging and North America. The table also shows the weights and returns of the fund's benchmark portfolio, the World Index. World Value Fund weight (%) World Value Fund return (%) World Index weight (%) World Index return (%) Europe Pacific Emerging North America 22.2 28.0 16.3 -3.4 4.5 12.8 20.0 18.5 12.0 0.1 4.7 10.6 33.5 3.4 49.5 2.7 (a.) How did the World Value fund perform compared with the benchmark, overperformance or un- derperformance? (b.) Provide a performance attribution of World Value's return in terms of its broad asset class allo- cation and stock selection relative to the benchmark. 1. Consider a 4-year Euro-note, with a $100,000 face value, a coupon rate of 10% and a convexity of 63.29. The Euro-note's YTM today is 11.5%. The coupon frequency is assumed to be annual. (a.) What is the duration of this bond? (b.) What is the exact price change in dollars if the YTM decreases by 50 basis points? (c.) Use the duration model to calculate the approximate price change in dollars if the YTM decreases by 50 basis points. (d.) What does convexity measure? Incorporate convexity to calculate the approximate price change in dollars if the YTM decreases by 50 basis points. 2. An insurance company is obligated to pay $200,000 at the end of year 4 and $500,000 at the end of year 7. The company wants to immunize its position. The current interest rate is 10 percent per year. (a.) What is the duration of its obligation? (b.) If the plan uses a zero-coupon bond with maturity of 5 years, and a 30-year annuity currently yielding 10 percent to construct the immunized position, how much money ought to be placed in each asset? (c.) Suppose the market interest rate remains unchanged. Is the position still immunized after one year? Why? 3. Risk-free zero-coupon government bonds have the following terms and yields to maturity Term to Maturity 1 year 2 years 3 years 4 years 5 years Yield to Maturity 3.2% 3.7% 4.5% 4.1% 3.9% (a.) Find the market prices for each of the bonds given a par value of $1000. (b.) Calculate the implied forward rates for all five years. (e.) Draw the yield curve and the forward rate curve in one diagram. (d.) Under the liquidity preference hypothesis of the term structure, suppose that liquidity premiums are expected to remain constant at 1%. What are the expected short rates in year 2 to year 5. 4. A University endowment fund's current holdings are listed below: Bond Credit rating Maturity (yrs.) Coupon rate Modified Duration Market value A B C D Govt. Aaa Baa Baa 3 10 5 12 0820 12 Portfolio X S&P 500 T-bills 2.273 6.404 3.704 10.909 a) Suppose you learn that the modified duration of the endowment's liabilities is 6.5 years. Identify whether the bond portfolio is immunized against interest rate risk. b) Your current active view for the fixed income market over the coming months is that Treasury yields will decline and corporate credit spreads will also decrease. Briefly discuss how you could restructure the existing portfolio to take advantage of this view. 5. Shares of XYZ Corp. pay a $2 dividend at the end of every year on December 31. An investor buys two shares of the stock on January 1 at a price of $20 each, sells one of those shares for $22 a year later on the next January 1, and sells the second share an additional year later for $19. Find the dollar- and time-weighted rates of return on the 2-year investment. $30,000 $30,000 $30,000 $30,000 $120,000 6. An analyst wants to evaluate portfolio X, consisting entirely of U.S. common stocks. The following table provides the average annual rate of return for portfolio X, the market portfolio (as measured by the S&P 500), and U.S. Treasury bills during the past 8 years: Average annual return Standard deviation Beta 10% 0.6 12% 4% 18% 13% 0 1.0 0 (a.) Calculate the Sharpe ratio, Treynor measure and Jensen's alpha for both portfolio X and S&P500 index. Also calculate the M for portfolio X. (b.) On the basis of the performance of portfolio X relative to the S&P 500 calculated in part briefly explain the reason for the conflicting results when using the Treynor measure versus the Sharpe ratio.

Step by Step Solution

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Here are the steps to solve this portfolio evaluation problem 1 Calculate the Sharpe ratio for portf... View full answer

Get step-by-step solutions from verified subject matter experts