Cool Ltds main financial objective is to maximise the wealth of its shareholders. Cool specialises in providing

Question:

Cool Ltd’s main financial objective is to maximise the wealth of its shareholders. Cool specialises in providing a service for its clients. All of the work that it undertakes is of a similar type for similar clients.

Cool’s management is contemplating offering a new service. This will require the acquisition of an item of plant on 1 June 20X4.

Cool intends to buy the plant for £300,000, payable on the date of acquisition. It is estimated that the asset will have a negligible market value by 31 May 20X8 and will be scrapped on that date.

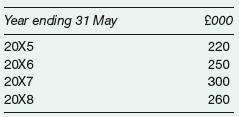

A study of likely sales demand for the new service suggests that it will be as follows:

Variable operating costs associated with the new service are estimated at 30 per cent of the sales revenue figure.

The introduction of the new service is planned to coincide with the discontinuance of an existing activity. This discontinuance will release labour. If the new service is introduced, the staff currently employed on the existing activity can all be fully employed throughout the four years at a total salary bill of £45,000 p.a.

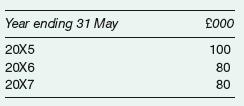

If the new service is not introduced, it is estimated that the existing activity could be kept going until 31 May 20X7, generating revenues as follows:

Variable operating costs associated with the existing service are also estimated at 30 per cent of the sales revenue figure.

If the new service is not introduced, it is envisaged that the staff will be made redundant and paid total redundancy pay of £20,000 on 31 May 20X7. This item was taken into account in the analysis on which the original decision to start the existing service was based, several years ago. If the new service is introduced, staff will be made redundant upon its conclusion on 31 May 20X8. Staff will be paid total redundancy pay of £22,000 at that time.

Labour is a fixed cost (that is, it does not vary with the level of output). Exactly the same staff will be employed in the provision of either service.

Apart from those that have already been mentioned, there are estimated to be no incremental operating costs involved with offering these services.

The cost of finance to support the project is expected to be 10 per cent p.a.

(a) Prepare a schedule that derives the annual net relevant cash flows associated with the decision whether Cool should acquire the plant and offer the new service, based on the information provided above. Use it to draw a conclusion about this decision on the basis of the project’s net present value as at 31 May 20X4.

(b) Estimate the internal rate of return for the project.

(c) Discuss the factors that Cool needs to take into account in respect of the decision, other than the NPV and IRR.

Step by Step Answer: