Plaything plc has just developed a new mechanical toy, the Nipper. The development costs totalled 300,000. To

Question:

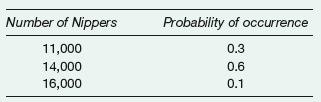

Plaything plc has just developed a new mechanical toy, the Nipper. The development costs totalled £300,000. To assess the commercial viability of the Nipper a market survey has been undertaken at a cost of £35,000. The survey suggests that the Nipper will have a market life of four years and can be sold by Plaything plc for £20 per Nipper. Demand for the Nipper for each of the four years has been estimated as follows:

If the decision is made to go ahead with the Nipper, production and sales will begin immediately. Production will require the use of machinery that the business already owns, having bought it for £200,000 three years ago. If Nipper production does not go ahead the machinery will be sold for £85,000, there being no other use for it. If it is used in Nipper production, the machinery will be sold for an estimated £35,000 at the end of the fourth year. Each Nipper will take one hour’s labour of employees who will be taken on specifically for the work at a rate of £8.00 per hour. The business will incur an estimated £10,000 in redundancy costs relating to these employees at the end of the four years.

Materials will cost an estimated £6.00 per Nipper. Nipper production will give rise to an additional fixed cost of £15,000 p.a.

It is believed that if Plaything plc decides not to go ahead with producing the Nipper, the rights to the product could be sold to another business for £125,000, receivable immediately.

Plaything plc has a cost of capital of 12 per cent p.a.

(a) On the basis of the expected net present value, should the business go ahead with production and sales of the Nipper? (Ignore taxation and inflation.)

(b) Assess the expected net present value approach to investment decision making.

Step by Step Answer: