Question: The returns on n = 4 assets are described by a Gaussian (Normal) random vector r R n , having the following expected value

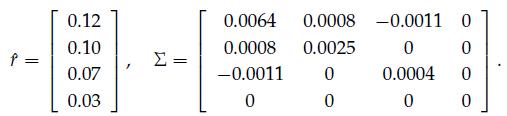

The returns on n = 4 assets are described by a Gaussian (Normal) random vector r ∈ Rn, having the following expected value ˆr and covariance matrix ∑:

The last (fourth) asset corresponds to a risk-free investment. An investor wants to design a portfolio mix with weights x ∈ Rn (each weight xi is nonnegative, and the sum of the weights is one) so to obtain the best possible expected return r̂ T x, while guaranteeing that:

(i) No single asset weights more than 40%;

(ii) The risk-free assets should not weight more than 20%;

(iii) No asset should weight less than 5%;

(iv) The probability of experiencing a return lower than q = –3% should be no larger than ϵ = 10–4. What is the maximal achievable expected return, under the above constraints?

P = 0.12 0.10 0.07 0.03 = 0.0064 0.0008 0.0008 0.0025 -0.0011 0 0 0 0.0011 0 0.0004 0 0 0 0 0

Step by Step Solution

3.54 Rating (158 Votes )

There are 3 Steps involved in it

All constraints in this problem are simple linear constraints exce... View full answer

Get step-by-step solutions from verified subject matter experts