Complete the Payroll Register for the February and March biweekly pay periods, assuming benefits went into effect

Question:

Complete the Payroll Register for the February and March biweekly pay periods, assuming benefits went into effect as anticipated.

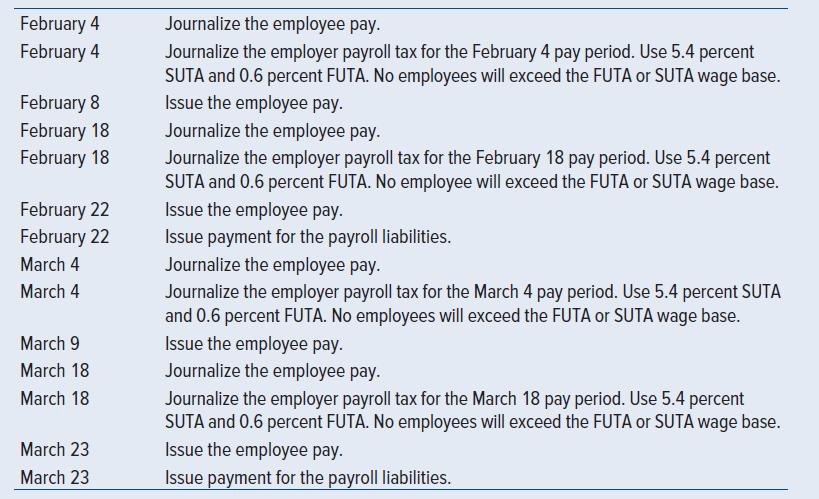

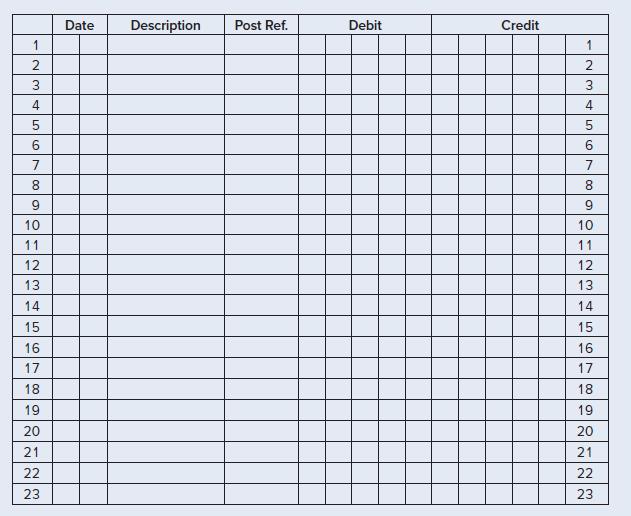

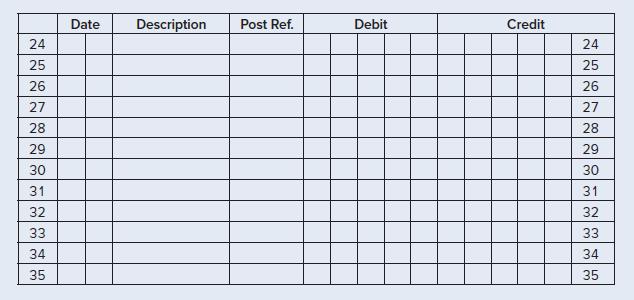

Use the Wage-Bracket Method Tables for Income Tax Withholding in Appendix C (or the IRS federal income tax withholding assistant). Complete the General Journal entries as follows:

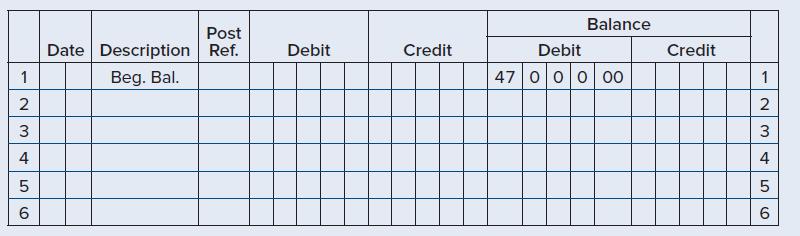

Post all journal entries to the appropriate General Ledger accounts.

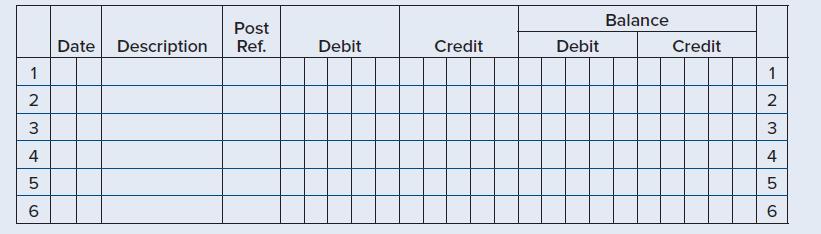

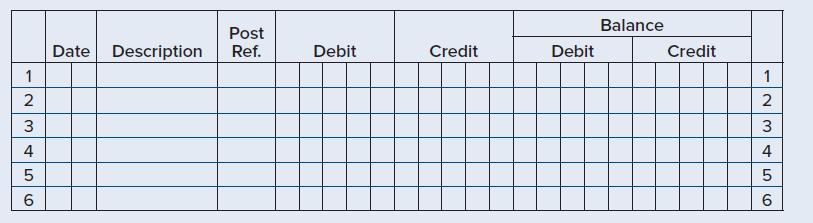

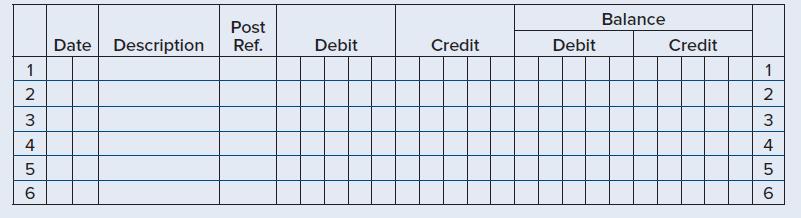

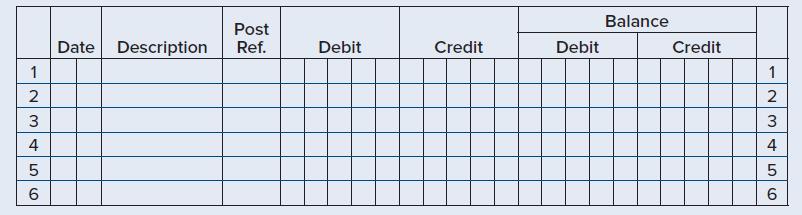

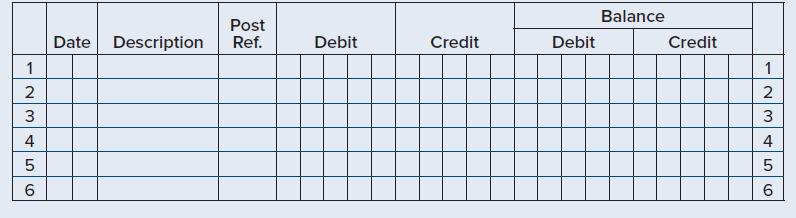

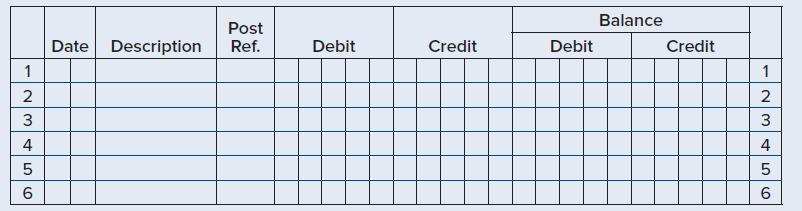

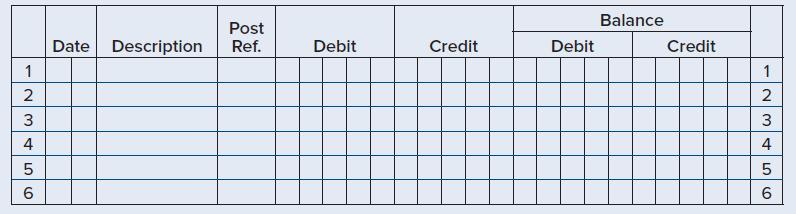

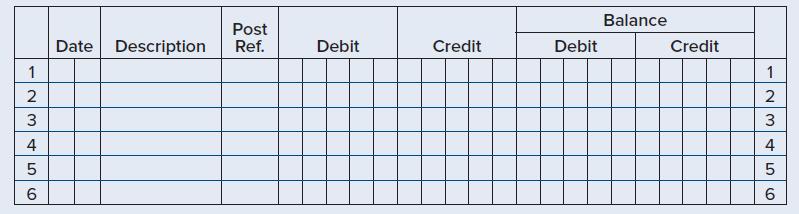

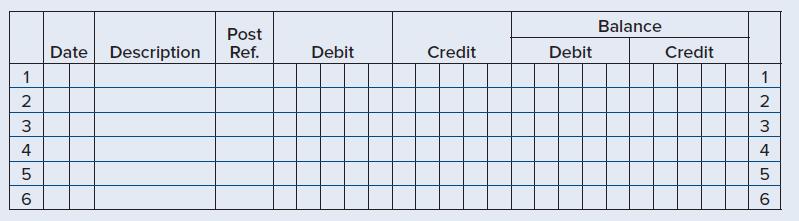

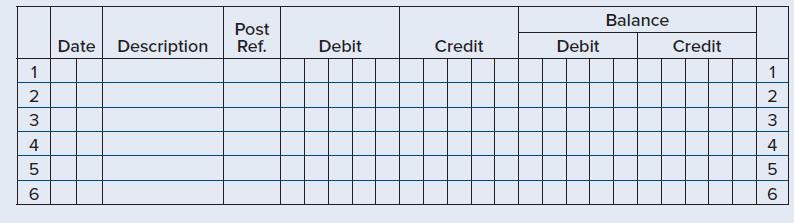

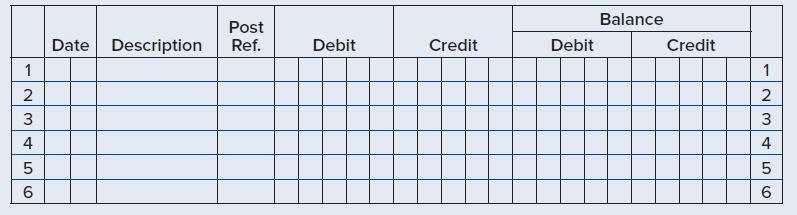

Account: Cash 101

Account: Employee Federal Income Tax Payable 203

Account: Social Security Tax Payable 204

Account: Medicare Tax Payable 205

Account: Employee State Income Tax Payable 206

Account: 401(k) Contributions Payable 208

Account: Health Insurance Payable 209

Account: Salaries and Wages Payable 210

Account: FUTA Tax Payable 211

Account: SUTA Tax Payable 212

Account: Payroll Taxes Expense 514

Account: Salaries and Wages Expense 515

Step by Step Answer:

Payroll Accounting 2023

ISBN: 9781264415618

9th Edition

Authors: Jeanette M. Landin, Paulette Schirmer