For the February 4, 2022, pay period, use the gross pay totals from the end of Chapter

Question:

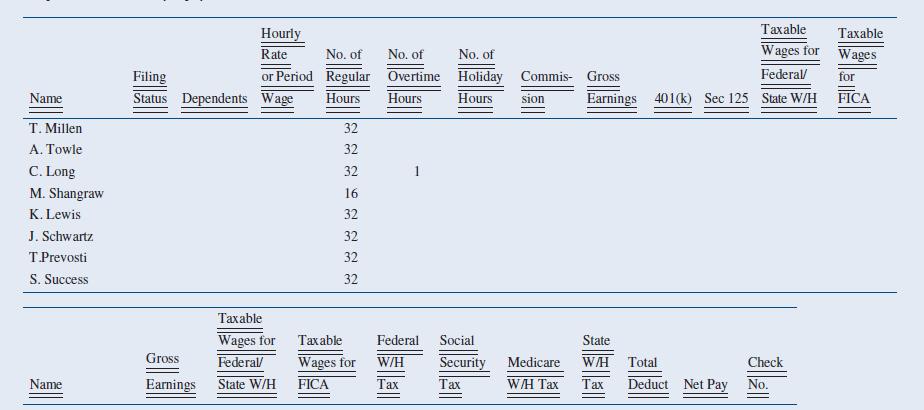

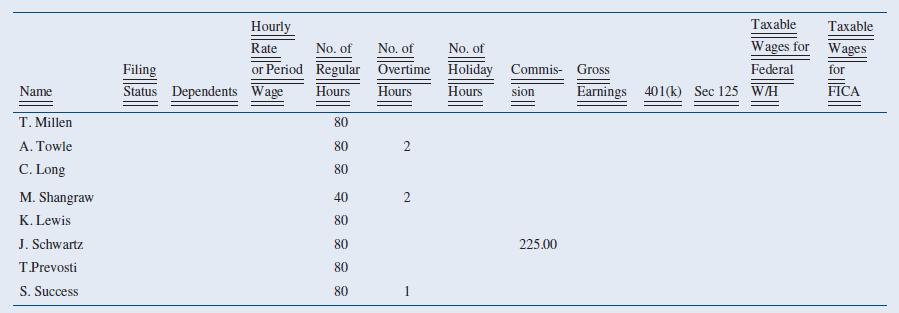

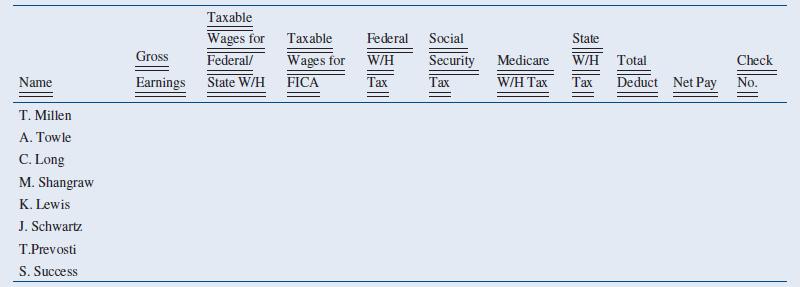

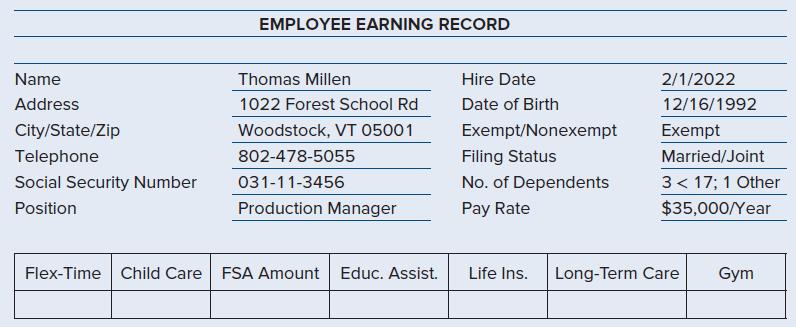

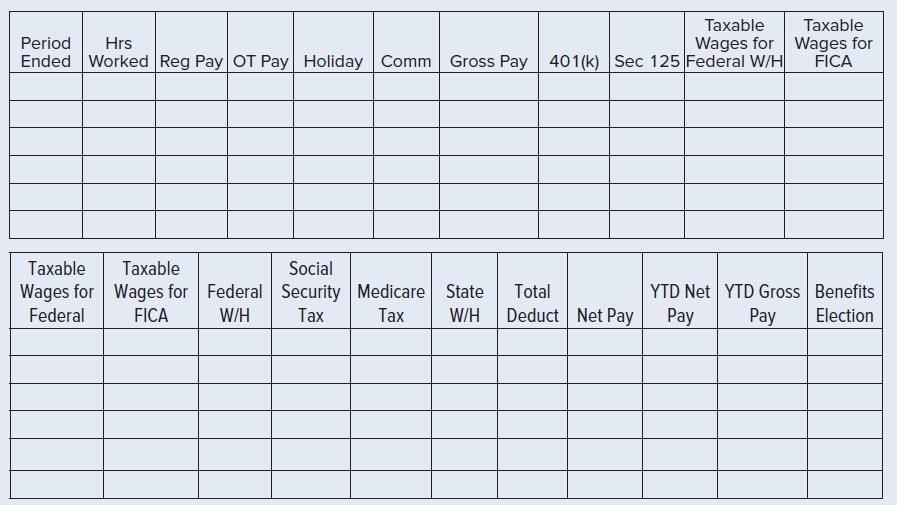

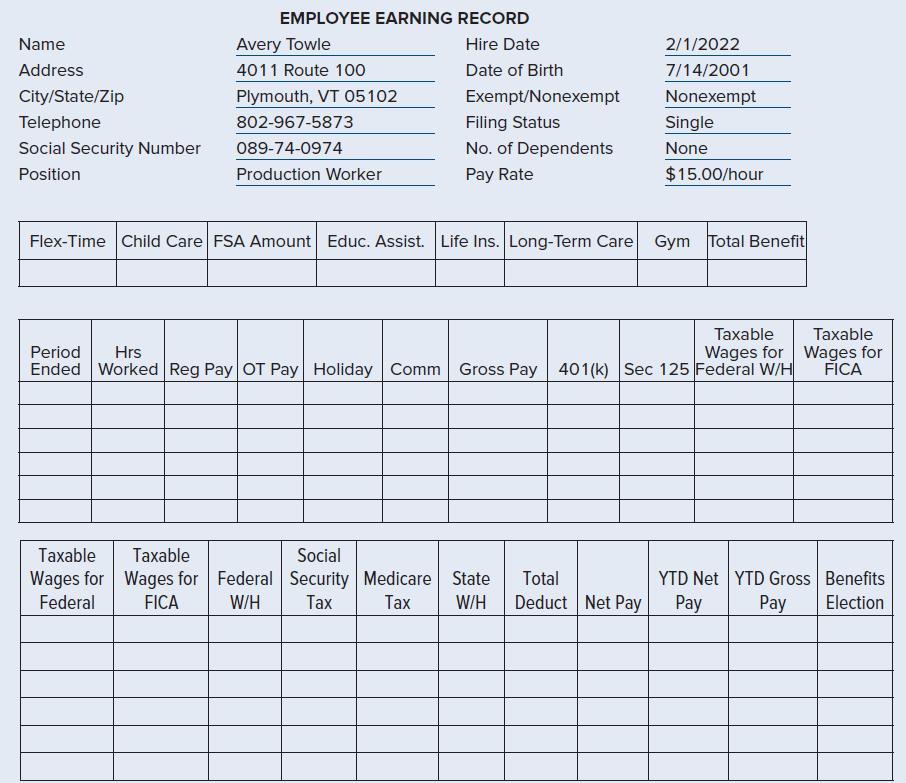

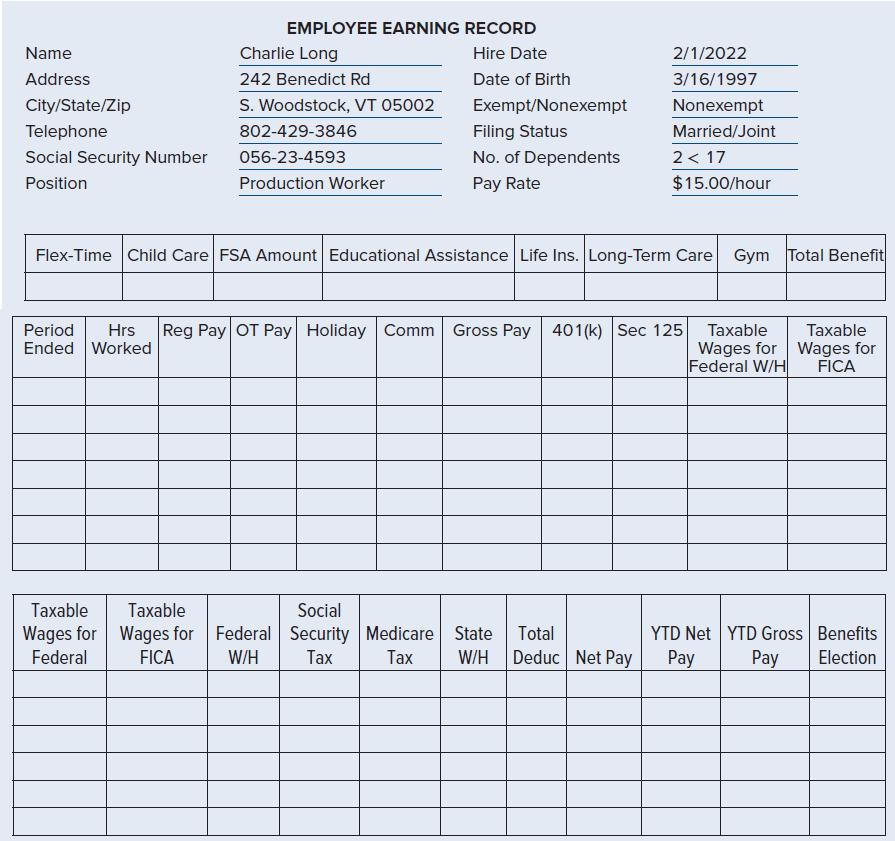

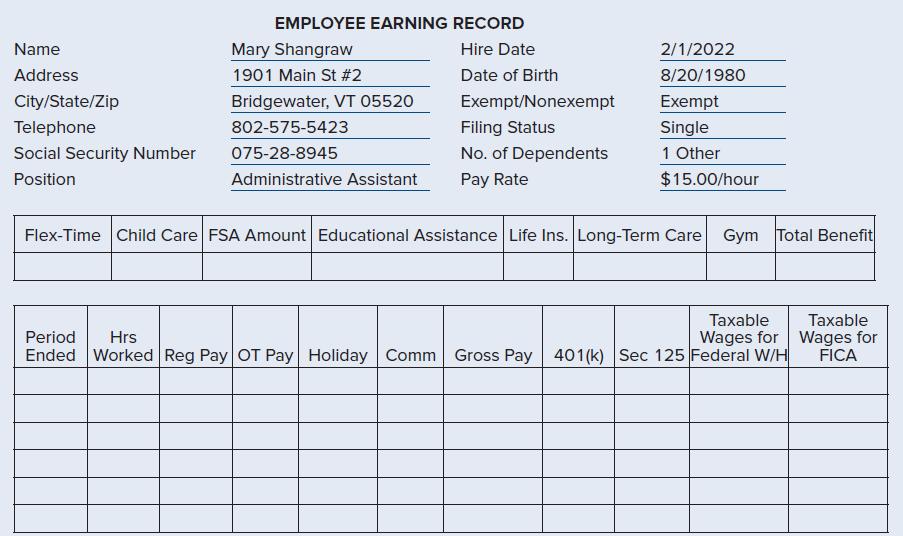

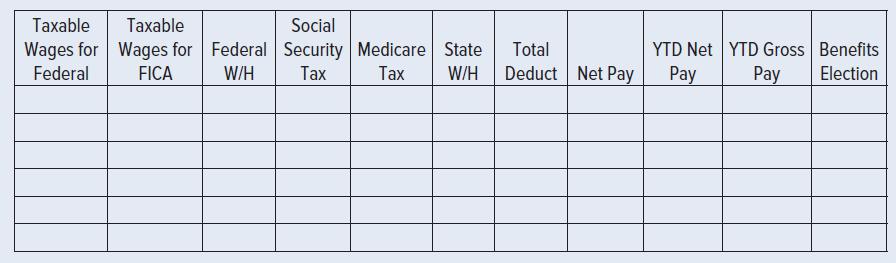

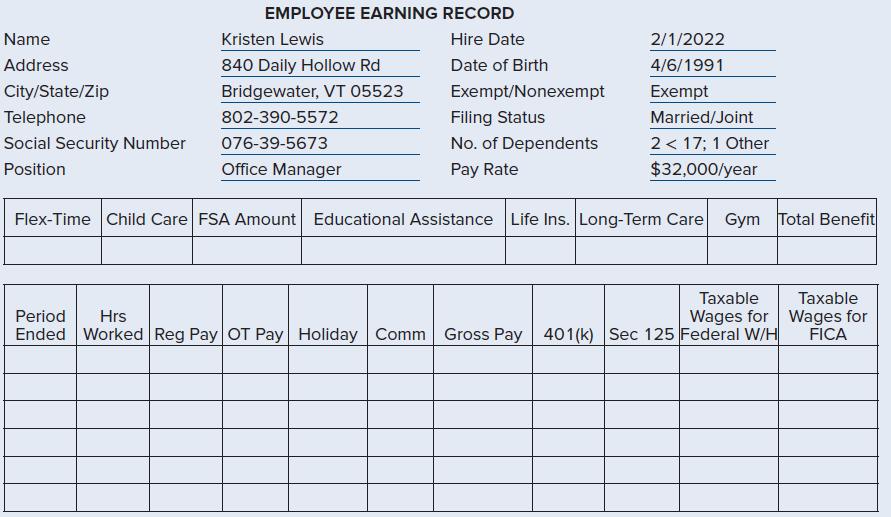

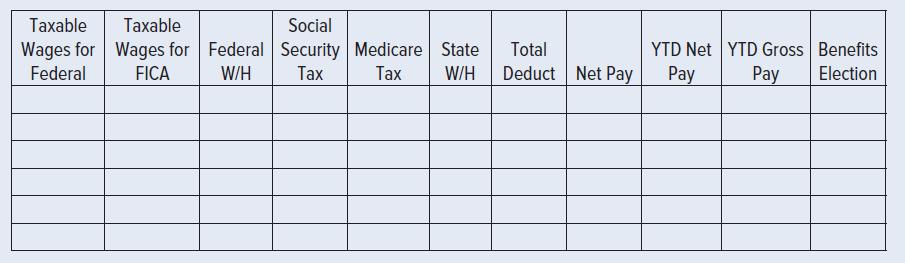

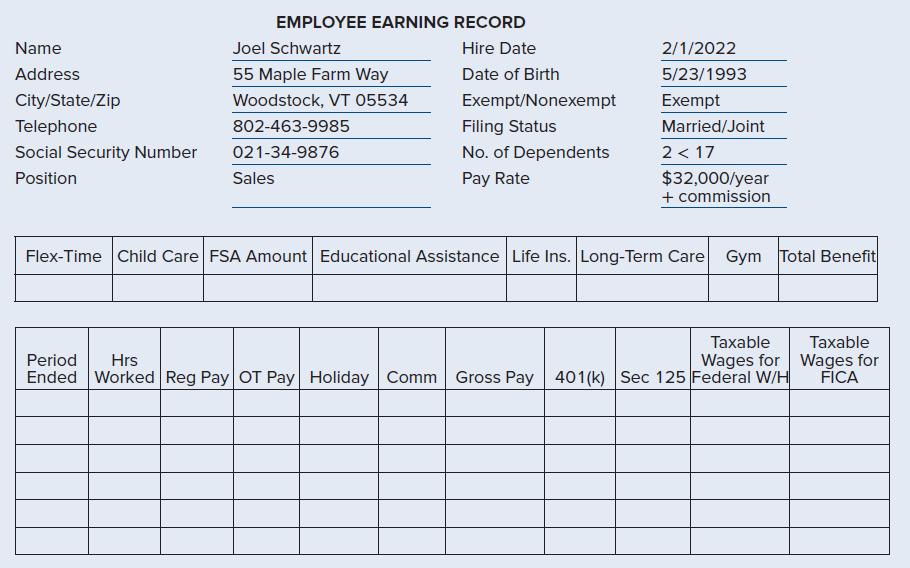

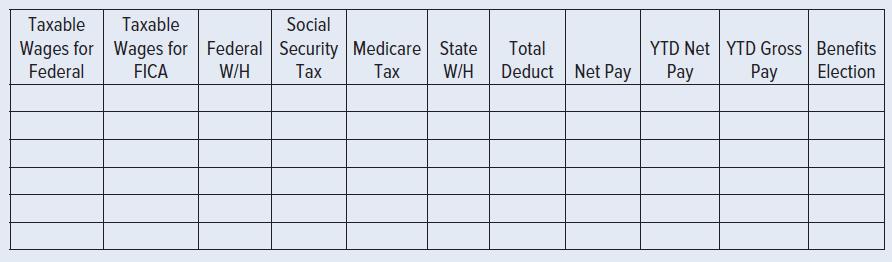

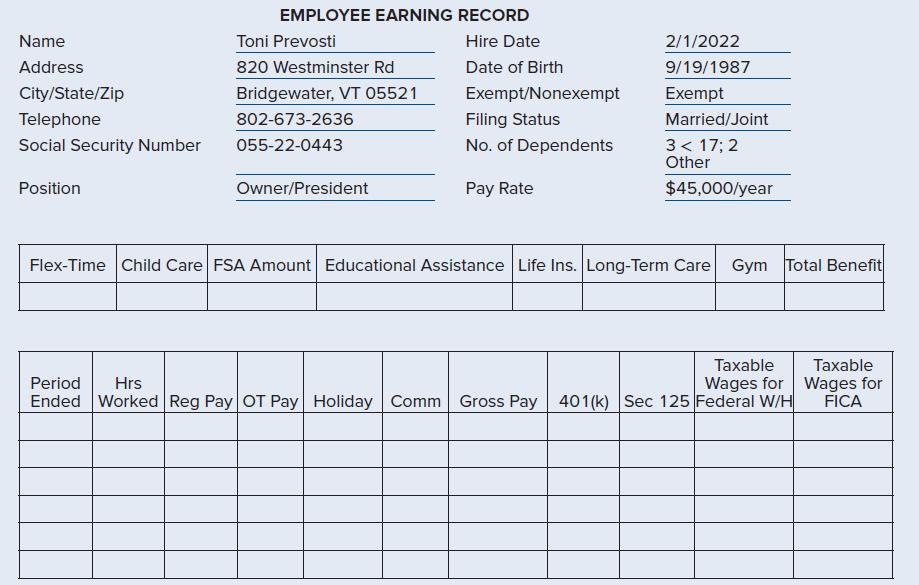

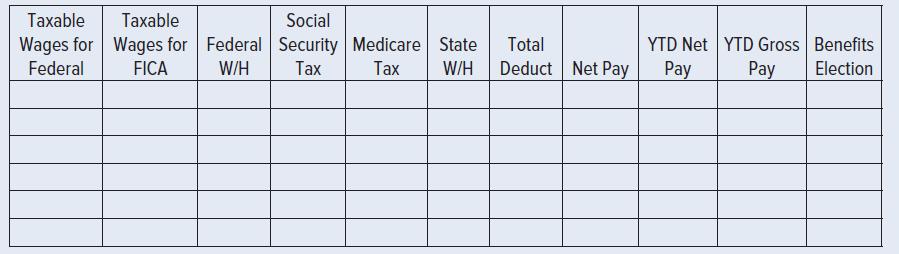

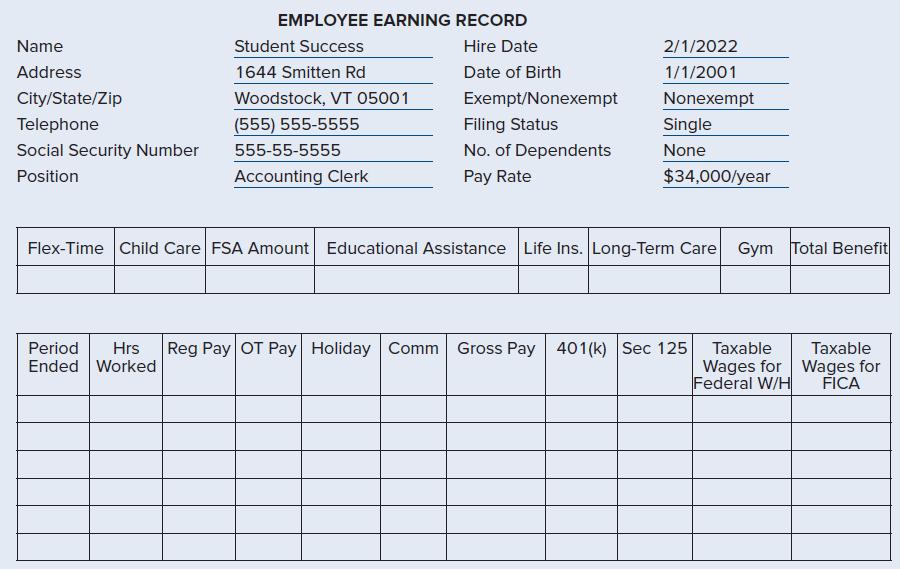

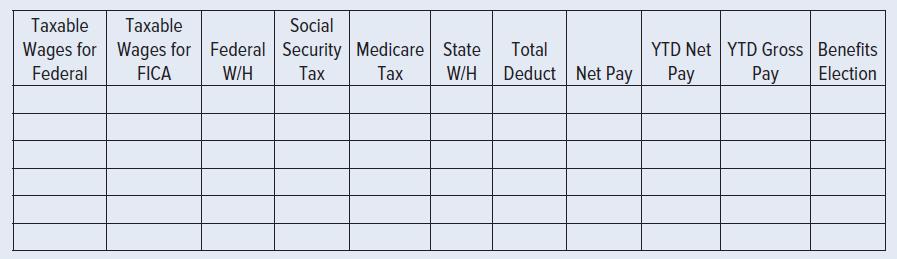

For the February 4, 2022, pay period, use the gross pay totals from the end of Chapter 3 to compute each employee’s net pay. Once you have computed the net pay (use the wage-bracket tables in Appendix C), state withholding tax for Vermont is computed at 3.35 percent of taxable wages (i.e., gross pay less pre-tax deductions). Note that the first pay period comprises only one week of work during the February 4 pay period. The federal income tax should be determined using the biweekly tables in Appendix C.

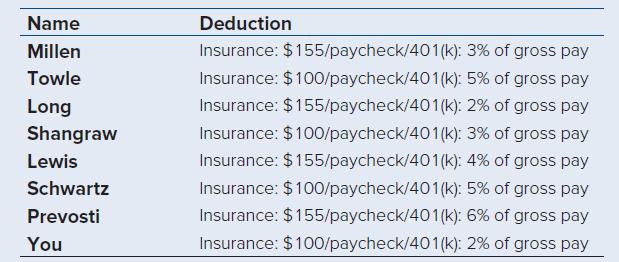

Initial pre-tax deductions for each employee are as follows:

February 4 is the end of the first pay period and includes work completed during the week of February 1–4. Compute the net pay for the February 4 pay period using the payroll register. All insurance and 401(k) deductions are pre-tax for federal and state. Update the Employee Earnings Records as of February 4, 2022. Recall there are only four working days in this first pay period.

February 18, 2022, is the end of the final pay period for the month. Schwartz has sold $7,500 of products during this pay period at a 3 percent commission. Complete the payroll register for the period’s gross pay. Pay will be disbursed on February 22, 2022, and check numbers will continue from prior payroll.

Step by Step Answer:

Payroll Accounting 2023

ISBN: 9781264415618

9th Edition

Authors: Jeanette M. Landin, Paulette Schirmer